Malaysia’s Green Sukuk: Pioneering Sustainable Islamic Finance

1. Introduction: Malaysia’s Vision for Sustainable Islamic Finance

Malaysia has emerged as a global leader in the nascent yet rapidly expanding field of sustainable Islamic finance, particularly through its pioneering efforts in developing the green sukuk market. This innovative financial instrument represents a powerful convergence of ethical investment principles and critical environmental objectives, positioning Malaysia at the forefront of a global movement to channel capital towards a more sustainable future.

1.1. The Convergence of Green Finance and Islamic Principles

Sukuk, often described as Shari’ah-compliant financial certificates, function similarly to conventional bonds but are structured to generate returns for investors without infringing upon Islamic law.1 Unlike interest-bearing bonds, sukuk represent undivided shares in the ownership of tangible assets, usufruct, or specific projects, ensuring that funds are tied to real economic activity.2 Green bonds, on the other hand, are financial instruments specifically designed to fund environmentally sustainable projects.1

The inherent commonalities between sukuk and green bonds make their integration a natural fit. Both instruments are characterised by a focus on the designated use of proceeds, providing investors with a high degree of certainty regarding how their funds will be deployed.1 Furthermore, both are deeply rooted in ethical and socially responsible principles. Shari’ah, the body of Islamic law, intrinsically emphasises environmental stewardship, encompassing the protection of air, water, land, and the ecosystems that depend on them.1 This ethical foundation naturally aligns with the objectives of green finance, while also precluding investments in activities deemed unethical, such as gambling, weapons, pork, and alcohol.1

This profound ethical rooting provides green sukuk with a unique appeal that extends beyond purely financial considerations. The intrinsic alignment of Shari’ah principles with environmental stewardship is more than a mere descriptive point; it signifies a fundamental philosophical commonality. This deep ethical foundation distinguishes green sukuk from conventional green bonds, potentially attracting a broader investor base motivated by both financial returns and moral or religious values. This positions Malaysia’s leadership not just as a matter of financial innovation but as a strategic leveraging of a sincerely held ethical framework, acting as a long-term catalyst for market growth by offering a compelling narrative for investors seeking “finance with purpose”.1

The confluence of these principles unlocks immense potential, enabling green sukuk to channel significant capital from the estimated $2 trillion global Islamic finance market towards critical green and sustainable investment projects worldwide.1 Malaysia’s instrumental role in launching the world’s first green sukuk in 2017 marked a pivotal moment in this convergence, solidifying its pioneering status in this burgeoning financial domain.1

1.2. Malaysia’s Global Leadership in Pioneering Green Sukuk

Malaysia has long held a dominant position in the global Islamic debt market, establishing itself as the world’s largest Shari’ah-compliant debt market. In 2016, Malaysia accounted for $34.7 billion, representing 46.4% of the $74.8 billion issued globally. This leadership continued into 2018, with Malaysia maintaining a substantial 39.2% market share, significantly outpacing Saudi Arabia (20.4%) and Indonesia (17.5%).1

This market dominance is not accidental but a deliberate outcome of Malaysia’s proactive regulatory approach. As early as 2014, the Securities Commission Malaysia (SC) introduced the Socially Responsible Investment (SRI) Sukuk Guidelines, strategically positioning the nation as a hub for sustainable finance even before the world’s first green sukuk was issued.1 This foresight laid the essential groundwork for future innovations by providing the necessary certainty and structure for the market to emerge and thrive, thereby attracting both issuers and investors. This highlights that Malaysia’s market leadership is not merely a result of being the first mover, but a deliberate outcome of a robust and adaptable regulatory environment. This proactive stance is a key competitive advantage, signalling to the global market that Malaysia is a stable and supportive jurisdiction for sustainable Islamic finance innovation. The landmark issuance of the world’s first green sukuk in 2017 by a Malaysian solar photovoltaic company further cemented Malaysia’s pioneering status and its commitment to advancing sustainable development through Islamic finance.1

2. Malaysia’s National Sustainability Agenda

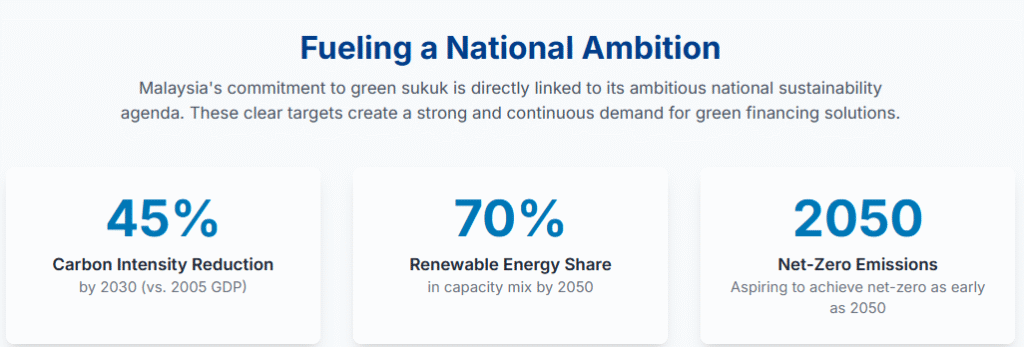

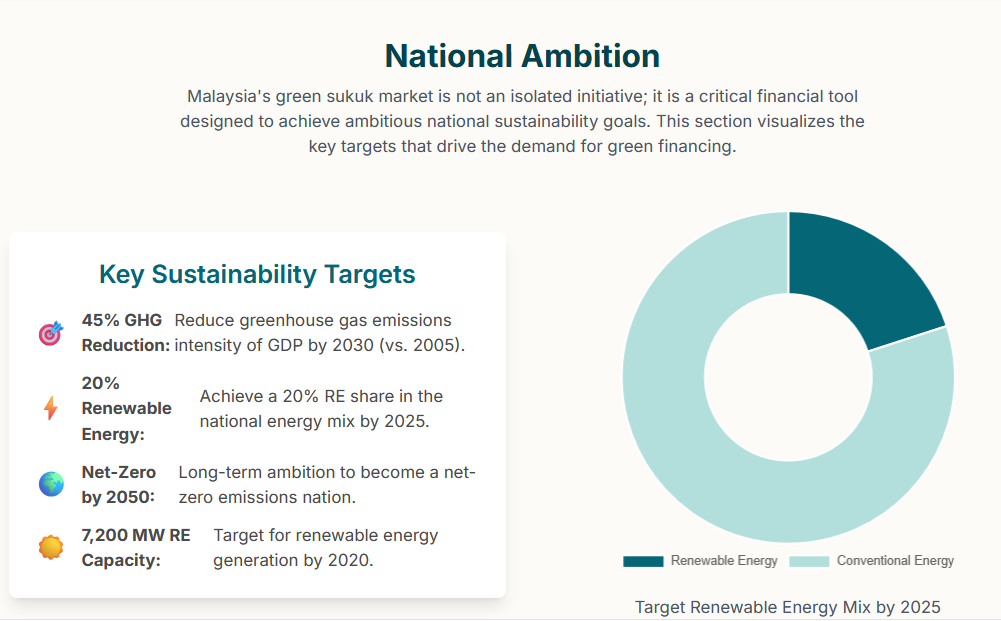

Malaysia’s commitment to green sukuk is deeply intertwined with its ambitious national sustainability agenda, which outlines clear targets for climate action and renewable energy integration. These national objectives provide the strategic impetus and a robust pipeline for green finance instruments.

2.1. Climate Change Commitments and Nationally Determined Contributions (NDCs)

Malaysia has made significant international commitments to combat climate change. The nation has pledged to reduce its economy-wide carbon intensity against GDP by 45% in 2030 compared to 2005 levels, with an even more ambitious target of a 60% reduction by 2035.8 These targets are integral to Malaysia’s Nationally Determined Contributions (NDCs) under the Paris Agreement. Beyond these mid-term goals, Malaysia has also set a long-term aspiration to achieve net-zero greenhouse gas emissions as early as 2050.10

However, official reports candidly acknowledge that existing measures are currently insufficient to meet either the 2030 NDC target or the 2050 net-zero ambition, necessitating a “transformational shift” in policy and investment.10 This simultaneous presentation of ambitious climate targets alongside the explicit acknowledgement that current measures are inadequate creates a clear and urgent national imperative. This gap signifies that traditional funding mechanisms alone cannot achieve these goals. Therefore, green sukuk is positioned not merely as an alternative financial product but as a critical strategic tool to bridge the significant climate financing shortfall and enable the nation to meet its ambitious, yet currently unmet, climate commitments. This underscores the deep integration of green finance, specifically green sukuk, into Malaysia’s national development and climate strategy, implying that the government will continue to prioritise and actively support these instruments as a matter of national policy, given the urgency and scale of the climate challenge. This provides a strong, long-term policy tailwind for the green sukuk market.

2.2. Renewable Energy Roadmap (MyRER) and Decarbonization Strategies

Central to Malaysia’s decarbonization efforts is the Malaysia Renewable Energy Roadmap (MyRER), which outlines aggressive renewable energy (RE) capacity targets. The nation aims for a 31% RE share in the national installed capacity mix by 2025, further increasing to 40% by 2035, and an ambitious 70% by 2050.8 To achieve these goals, MyRER formulates comprehensive strategies, including accelerating rooftop and large-scale solar photovoltaic (PV) deployment, leveraging the full potential of bio-energy and hydro resources, and exploring new energy technologies such as green hydrogen post-2025.8

Enabling initiatives outlined in MyRER include enhancing the Net Energy Metering (NEM) program, which involves reviewing tariffs, removing capacity limits, and introducing virtual net metering. The roadmap also explores new business models, such as grid extension to leverage resources and NEM for bioenergy, alongside optimising the Feed-in Tariff (FiT) mechanism.8 The build-up of RE capacity until 2035 is projected to support over MYR 53 billion in investments and generate 46,636 direct and indirect jobs in the RE sector, highlighting the significant socio-economic benefits anticipated from this transition.8 The MyRER document provides a detailed blueprint for RE development, specifying targets and actionable strategies for solar, bio-energy, and hydro. The explicit mention of substantial investment figures and job creation serves as a direct signal to financial markets. This detailed roadmap translates national ambitions into concrete, long-term investment opportunities, effectively de-risking and highlighting specific sectors for green financing. This demonstrates that Malaysia’s government is not just setting broad targets but is actively creating the conditions for private capital to flow into specific, high-impact renewable energy projects. This clarity in sectoral prioritisation and the promise of significant socio-economic returns make these projects highly attractive for green sukuk financing, providing a robust pipeline for future issuances.

2.3. Broader Energy Transition and Efficiency Initiatives

Malaysia’s energy transition strategy extends beyond renewable energy generation to encompass a holistic approach to decarbonization. The country has committed to phasing out coal by 2045. It has ceased adding new coal capacity since 2020.9 The overarching strategic direction for Malaysia’s energy trajectory is guided by the National Energy Policy (2022-2040) and the National Energy Transition Roadmap (2023).9

Further demonstrating its commitment to efficient energy use, Malaysia officially implemented its Energy Efficiency and Conservation Act at the start of 2025. This legislation mandates energy audits every five years for heavy industrial and commercial users consuming over 21.6 TJ per annum, promoting efficient energy use and waste reduction.9 Additionally, the government is actively seeking to expand Battery Energy Storage Systems (BESS) with a total capacity of 500MW from 2030 onwards to support ambitious solar targets.12 Plans are also underway to develop an intelligent, automated, digitally-enabled national grid, aiming for greater cost efficiency, reliability, and customer satisfaction.12 The commitment to phasing out coal, the enactment of an Energy Efficiency and Conservation Act, and the strategic investment in BESS and smart grids reveal a comprehensive, multi-faceted decarbonization approach beyond just renewable energy generation. This expands the definition of “green” projects eligible for sukuk financing to include energy efficiency upgrades, grid modernisation, and potentially industrial decarbonization, which are often harder to finance. This broadens the scope for green sukuk beyond traditional renewable energy projects, offering a more diverse range of investment opportunities for issuers and investors interested in the broader spectrum of sustainable infrastructure and technology. It positions green sukuk as a flexible instrument for financing a multi-faceted energy transition, including “transition finance” for carbon-intensive industries.

Table 1: Malaysia’s Key Climate and Renewable Energy Targets

| Target Year | Target Description | Specific Target Value |

| 2025 | RE share in the national installed capacity mix | 31% |

| 2030 | Economy-wide carbon intensity reduction (vs. 2005 GDP) | 45% |

| 2035 | RE share in the national installed capacity mix | 40% |

| 2035 | GHG emission reduction in the power sector (vs. 2005 GDP) | 60% |

| 2040 | Installed RE capacity | 18.4 GW |

| 2045 | Coal power phase-out | By 2045 |

| 2050 | RE share in the national installed capacity mix | 70% |

| 2050 | Net Zero GHG emissions | As early as 2050 |

| 2050 | Installed solar PV capacity | 59 GW |

3. The Malaysian Green Sukuk Market: Development and Impact

Malaysia’s green sukuk market has demonstrated remarkable evolution and tangible impact, driven by a responsive regulatory framework and a growing pipeline of sustainable projects.

3.1. Evolution of the Sustainable and Responsible Investment (SRI) Sukuk Framework

The foundation of Malaysia’s sustainable finance market was laid in 2014 with the introduction of the Sustainable and Responsible Investment (SRI) Sukuk Framework by the Securities Commission Malaysia (SC).1 This framework was designed to foster an ecosystem that promotes sustainable and responsible investing, addresses climate change, and encourages socially responsible initiatives. Crucially, the framework aligns with international standards and best practices, including the International Capital Market Association (ICMA)’s Green Bond Principles (GBP) and the ASEAN Green Bond Standards (AGBS), emphasising transparency in disclosure requirements.1 The SC has also played a leading role in shaping regional standards, co-chairing the ASEAN Capital Markets Forum’s Sustainable Finance Working Group and leading the development of the ASEAN Green, Social, and Sustainability Bond Standards.16

In a significant advancement, the SC launched the SRI-linked Sukuk Framework in June 2022.16 This framework specifically facilitates “transition finance,” enabling companies, including those in hard-to-abate sectors, to raise funds tied to their sustainability performance commitments. This supports their transition towards a low-carbon or net-zero economy. The progression from the initial SRI Sukuk Framework to the more nuanced SRI-linked Sukuk Framework is a clear indicator of a dynamic and responsive regulatory approach. The SRI-linked framework, designed explicitly for hard-to-abate sectors and transition finance, demonstrates an understanding of the complexities of decarbonization beyond just “pure green” projects. This adaptability is crucial for expanding the market’s reach and relevance to a broader range of industries. This highlights that Malaysia’s regulators are not static; they are actively refining frameworks to meet evolving market needs and global sustainability challenges. This proactive stance enhances Malaysia’s attractiveness as a sustainable finance hub and positions green sukuk as a versatile tool for a broader range of sustainability transitions, including those that involve gradual decarbonization.

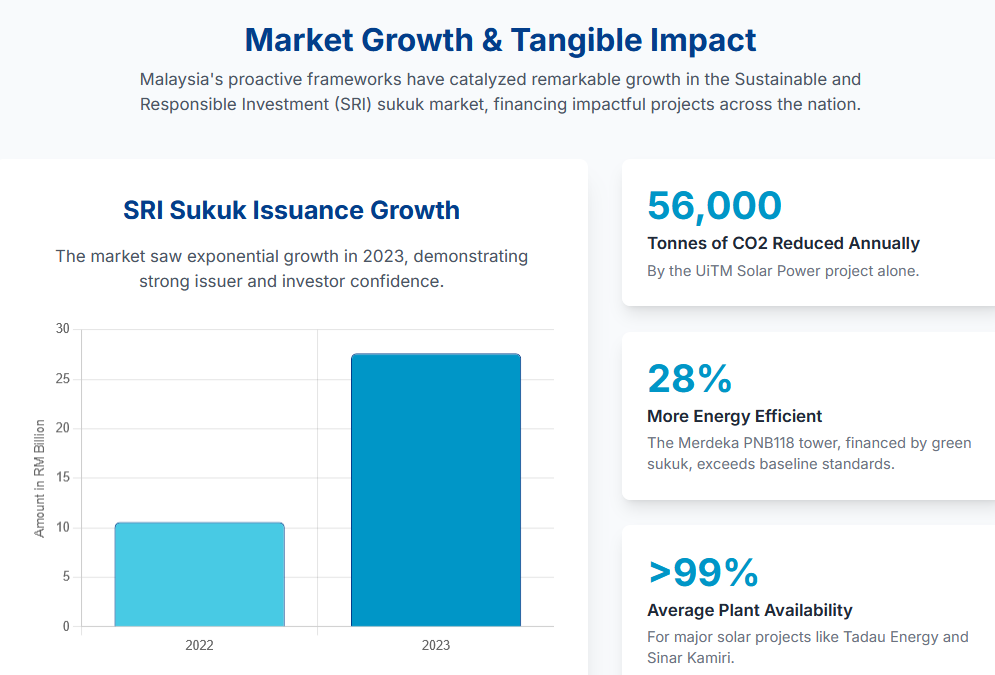

The market has responded positively to these frameworks. Cumulative SRI sukuk issuance in Malaysia reached RM18.92 billion by the end of 2022, with RM10.58 billion issued in 2022 alone. This growth continued significantly, with RM27.61 billion issued in 2023.16

3.2. Significant Green Sukuk Issuances and Project Case Studies

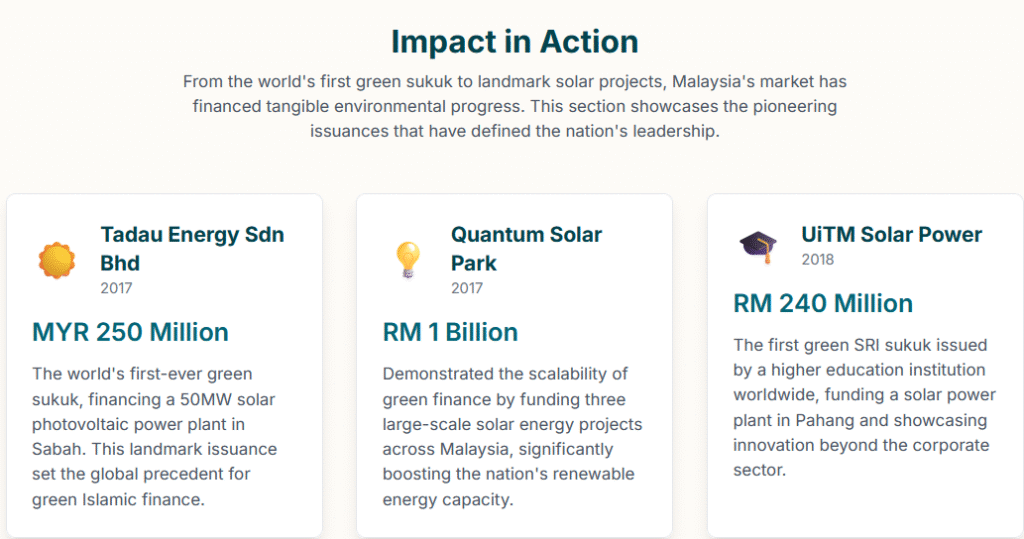

Malaysia’s green sukuk market has financed a diverse array of projects, demonstrating tangible environmental and social benefits:

- Tadau Energy Sdn. Bhd. (2017): This Malaysian solar photovoltaic company issued the world’s first green sukuk, amounting to RM250 million (approximately USD 58.4 million), to finance a 50MW solar project in Kudat, Sabah.2 The project received a “Dark Green” rating from CICERO, signifying strong environmental credentials.23 Operationally, the plants have consistently exceeded energy production projections (P90) by 11.4% and 8.5% in 2023 and maintained an impressive average availability of over 99%.24

- Quantum Solar Park Malaysia Sdn. Bhd. (2017): This entity issued an RM1 billion green SRI sukuk to fund the construction of three 50MW solar power plants located in Kedah, Melaka, and Terengganu.2 In 2023, the overall energy generation from these plants exceeded P90 projections by 0.25%.26 Despite a flood incident at the Merchang plant in late 2023 and early 2024, temporary repairs were swiftly completed, and full rectification was achieved by April 2025, with costs expected to be covered by insurance.27

- PNB Merdeka Ventures Sdn. Bhd. (2017): An unrated green SRI sukuk of up to RM2 billion (with RM690 million issued) was utilised to partially finance the 83-story office space within the iconic Merdeka PNB118 tower in Kuala Lumpur.2 The tower is designed to achieve triple platinum ratings from leading sustainability certifications, including the Green Building Index (GBI), GreenRE, and Leadership in Energy and Environmental Design (LEED), having achieved LEED Platinum certification on March 26, 2024.28 It is estimated to be 28% more energy efficient than the ASHRAE 90.1-2007 baseline.30 Beyond its environmental attributes, the project has generated significant social impacts, including job creation, positive multiplier effects on the local economy, support for local suppliers, increased property values, and stimulation of the tourism sector.28

- Sinar Kamiri Sdn. Bhd. (2018): This company received approval to issue RM245 million to finance a 49MW solar photovoltaic facility in Perak.2 The plant commenced commercial operation in November 2018 and has maintained a stable operational profile with an average availability factor of 99.2%.31 It consistently exceeds P90 estimates, generating 80GWh of electricity and offsetting 50,000 tonnes of CO2 emissions annually.32

- UiTM Solar Power Sdn. Bhd. (USPSB) (2018): USPSB issued an RM240 million green SRI sukuk to fund the development and operation of a 50MW utility solar power plant in Pahang.2 This project generates approximately 80,000 MWh of clean energy, capable of powering up to 20,000 homes, and contributes to a reduction of 56,000 tonnes of carbon dioxide emissions per year.2

- Government of Malaysia (2021): The Government of Malaysia’s USD1.3 billion sovereign Sustainability Sukuk, issued in April 2021, marked a global first as the world’s first U.S. Dollar Sustainability Sukuk issued by a sovereign.19 The proceeds from this issuance are explicitly earmarked for eligible social and green projects aligned with the United Nations Sustainable Development Goals (SDGs), reinforcing Malaysia’s commitment to the Paris Agreement and advancing socio-economic well-being.19

While the initial green sukuk issuances were predominantly for solar projects, the PNB Merdeka 118 tower stands out as a significant non-renewable energy project. This diversification into green buildings, with explicit energy efficiency and social benefits, demonstrates the framework’s versatility and the market’s ability to fund a broader range of sustainable development. The detailed performance metrics for solar projects, such as exceeding P90 estimates, high availability, and significant CO2 avoidance, provide concrete evidence of environmental impact. This is crucial for investor confidence and market credibility. This showcases that Malaysia’s green sukuk market is not narrowly focused but can effectively finance diverse green sectors. The availability of detailed impact reports and performance data for these projects enhances market transparency and investor confidence, providing a strong basis for future issuances in varied green sectors and demonstrating the practical application of sustainable finance.

Table 2: Notable Green Sukuk Issuances in Malaysia

| Issuer | Amount (RM/USD) | Year of Issuance | Project Type | Key Environmental/Social Impact |

| Tadau Energy Sdn. Bhd. | RM250 million / USD 58.4 million | 2017 | Solar PV | 50MW capacity; “Dark Green” CICERO rating; consistently exceeded P90 energy production (11.4%, 8.5% in 2023); >99% availability |

| Quantum Solar Park Malaysia Sdn. Bhd. | RM1 billion | 2017 | Solar PV | Three 50MW solar power plants; 2023 generation exceeded P90 by 0.25%; rectification of flood damage by Apr 2025 |

| PNB Merdeka Ventures Sdn. Bhd. | Up to RM2 billion (RM690 million issued) | 2017 | Green Building (Merdeka PNB118 tower) | 83-story office space; triple platinum ratings (GBI, GreenRE, LEED Platinum achieved Mar 2024); 28% more energy efficient; job creation, economic multiplier, tourism stimulation |

| Sinar Kamiri Sdn. Bhd. | RM245 million | 2018 | Solar PV | 49MW capacity; 80GWh electricity generated annually; offsets 50,000 tonnes CO2/year; 99.2% average availability |

| UiTM Solar Power Sdn. Bhd. (USPSB) | RM240 million | 2018 | Solar PV | 50MW utility solar plant; 80,000 MWh clean energy (powers 20,000 homes); reduces 56,000 tonnes CO2/year |

| Government of Malaysia | USD1.3 billion (USD800M 10-yr, USD500M 30-yr) | 2021 | Sovereign Sustainability Sukuk (Green & Social Projects) | World’s first sovereign USD Sustainability Sukuk; proceeds for SDG-aligned social and green projects (e.g., public transport, healthcare, education, RE) |

3.3. Market Size, Growth Trends, and Contribution to Sustainable Development Goals (SDGs)

Malaysia continues to be a dominant force in the global sukuk market. Total sukuk issuance globally reached approximately $180 billion in 2024, with the market on pace to achieve $1 trillion outstanding in the coming years.35 Green sukuk, along with sustainable sukuk, currently represents around 10% of this overall sukuk market.35 Global sustainable sukuk issuance totalled $11.9 billion in 2024 36, with other reports indicating $11 billion for green and sustainability sukuk by Q3 2024 37, and $15.2 billion for ESG sukuk in 2024, marking a 14% year-on-year growth.38

Malaysia’s domestic SRI sukuk market has shown robust growth, with cumulative issuances reaching RM18.92 billion by the end of 2022, and a significant RM27.61 billion issued in 2023 alone.16 A landmark issuance was the Government of Malaysia’s USD1.3 billion sovereign Sustainability Sukuk in April 2021, which was the world’s first U.S. Dollar Sustainability Sukuk issued by a sovereign.19 The proceeds from this issuance are explicitly earmarked for eligible social and green projects aligned with the United Nations Sustainable Development Goals (SDGs), reinforcing Malaysia’s commitment to the Paris Agreement and broader socio-economic well-being.19

The market for green businesses in Asia is projected to grow substantially, reaching between USD4-5 trillion by 2030.39 However, the region faces a considerable financing challenge, requiring an annual investment of at least USD1.1 trillion to meet climate and mitigation adaptation needs, resulting in a significant USD800 billion gap in climate financing, particularly for renewable energy.39 The sheer scale of Asia’s climate financing needs and the projected growth of the green business market provide a powerful macro-economic context. Malaysia’s leadership in green sukuk, coupled with Asia’s significant share of global sukuk issuance (62.7% of outstanding sukuk), positions green sukuk as a vital mechanism to address this massive funding shortfall. The explicit linkage of the Government’s USD Sustainability Sukuk to SDGs demonstrates this strategic alignment at the highest level. Green sukuk is not merely a niche financial instrument; it is a critical component of the regional and global sustainable development agenda. Malaysia’s success in pioneering and scaling this market offers a replicable model for other Organisation of Islamic Cooperation (OIC) countries and emerging economies to tap into Islamic capital markets for climate action and SDG achievement, thereby fostering broader sustainable development.

4. Regulatory and Policy Ecosystem Supporting Green Sukuk

Malaysia’s leadership in green sukuk is underpinned by a sophisticated and synergistic institutional and policy framework, demonstrating a comprehensive approach to fostering sustainable Islamic finance.

4.1. Role of Securities Commission Malaysia (SC) and Bank Negara Malaysia (BNM)

The Securities Commission Malaysia (SC) has been instrumental in shaping the capital market frameworks that support sustainable finance. Its initiatives include the introduction of the foundational SRI Sukuk Framework in 2014 and the subsequent SRI-linked Sukuk Framework in June 2022, which facilitates transition finance.1 Beyond domestic policy, the SC plays a prominent role in regional standardisation, co-chairing the ASEAN Capital Markets Forum’s Sustainable Finance Working Group and leading the development of the ASEAN Green, Social, and Sustainability Bond Standards.16

Concurrently, Bank Negara Malaysia (BNM), the nation’s central bank, has actively collaborated with the SC and the World Bank since 2017 to develop the green sukuk market.1 BNM’s broader influence is evident in its Financial Sector Blueprint, which provides foundational support for promoting Value-Based Intermediation (VBI) among Islamic banks, emphasising value creation as a core operational principle.40 The active and coordinated involvement of both the SC (focusing on capital markets) and BNM (addressing the broader financial system and ethical finance), often in collaboration with international bodies like the World Bank, is a key differentiator. This collaborative approach ensures that both the product-specific market infrastructure and the broader ethical underpinnings of Islamic finance are developed in tandem. This division of labour, coupled with strong inter-agency cooperation, creates a comprehensive and mutually reinforcing ecosystem. This demonstrates that Malaysia’s success is not due to isolated policies but a well-orchestrated regulatory environment that addresses both market structure and ethical principles. This integrated approach minimises regulatory arbitrage, maximises the impact of sustainable finance initiatives, and enhances Malaysia’s credibility as a global Islamic finance hub.

4.2. Government Incentives and Support Schemes

To further incentivise and de-risk green sukuk issuances, the Malaysian government has implemented a suite of targeted financial support schemes:

- SRI Sukuk and Bond Grant Scheme: Established in 2018 (and formerly known as the Green SRI Sukuk Grant Scheme), this scheme, administered by Capital Markets Malaysia (CMM), covers up to 90% of the external review costs incurred by eligible issuers, with a maximum cap of RM300,000 per issuance.15 Its expansion in August 2022 to include SRI-linked sukuk aims explicitly to encourage transition finance, particularly for carbon-intensive industries.16

- Tax Incentives: Complementing the grant scheme, the Malaysian Budget 2021 introduced income tax exemptions for recipients of the SRI Sukuk and Bond Grant Scheme for five years, from Year of Assessment 2021 until 2025. This further reduces the overall cost of issuing green sukuk.20

- Green Technology Financing Scheme (GTFS): Launched by the Ministry of Finance in 2010, the GTFS provides a substantial 60% government guarantee on the financing amount and a 2% rebate on the interest/profit rate charged by financial institutions.42 This scheme is specifically designed to accelerate the expansion of green investments across various sectors.42

The existence of specific financial incentives like the SRI Grant Scheme and tax exemptions directly addresses a common barrier for green finance issuers – the additional costs associated with external reviews and verification.18 By significantly reducing these costs and offering government guarantees through GTFS, the government actively de-risks and incentivises the issuance of green sukuk. This demonstrates a clear understanding of market friction points and a strategic commitment to overcoming them. These incentives are crucial for encouraging both new and existing issuers, particularly those in carbon-intensive industries considering transition finance, to utilise green sukuk. They lower the entry barrier and improve the financial viability of green projects, thereby accelerating market adoption and contributing to the national sustainability agenda.

4.3. Value-Based Intermediation (VBI) Framework in Islamic Finance

Bank Negara Malaysia’s introduction of the Guidance Document on the Value-Based Intermediation Financing and Investment Impact Assessment Framework in November 2019 marked a significant philosophical shift in Islamic finance.43 VBI redefines the role of Islamic Financial Institutions (IFIs) by aligning their operations with principles that generate positive impacts on the economy, society, and environment—encapsulated in the “3P” approach: People, Planet, and Profit.40 This framework moves beyond mere Shari’ah compliance to integrate ethical considerations into core business practices, demonstrating that profitability and social responsibility are not mutually exclusive.40

VBI fosters inclusivity, supports underserved communities, and contributes to sustainable development, thereby upholding the core objectives of Shari’ah (maqāṣid al-Sharīʿah).40 The practical implementation and scale of VBI are evident in its tangible impact: from January 2017 to December 2023, Islamic banks in Malaysia channelled RM649.90 billion through VBI-driven initiatives, with RM216.07 billion intermediated in 2023 alone, directly benefiting 7.98 million accounts.40 This remarkable growth underscores VBI’s transformative influence, particularly its emphasis on small and medium enterprises (SMEs), micro-SMEs (MSMEs), net-zero, and green financing.40 VBI represents a significant evolution in Islamic finance, moving beyond a checklist approach to Shari’ah compliance towards a more holistic emphasis on the

impact and purpose of financial activities. By embedding “People, Planet, and Profit” into the core operations of IFIs, VBI creates a systemic, internal drive to seek out and finance projects with positive societal and environmental outcomes. The substantial financial flows attributed to VBI-driven initiatives demonstrate its practical implementation and scale. VBI reinforces the ethical underpinnings of green sukuk, not just as a standalone product but as part of a broader, systemic shift in Islamic banking towards holistic sustainable development. This creates a stronger internal mandate within IFIs to support green projects, complementing external market incentives and potentially leading to more innovative and impactful green sukuk structures. It also enhances the credibility of Malaysia’s Islamic finance sector as a leader in responsible finance.

Table 3: Overview of Malaysian Green Sukuk Regulatory Frameworks and Incentives

| Framework/Incentive | Issuing/Administering Body | Year Introduced | Key Objective/Feature |

| SRI Sukuk Framework | Securities Commission Malaysia (SC) | 2014 | Promote sustainable and responsible investing; facilitate financing for green, social, sustainable, and waqf projects. |

| SRI-linked Sukuk Framework | Securities Commission Malaysia (SC) | June 2022 | Facilitate transition finance for companies in hard-to-abate sectors; link financing to the issuer’s sustainability performance commitments. |

| SRI Sukuk and Bond Grant Scheme | Capital Markets Malaysia (CMM) | 2018 | Offset up to 90% (max RM300k) of external review costs for eligible SRI sukuk and bonds; expanded to SRI-linked sukuk in Aug 2022 |

| Income Tax Exemption | Ministry of Finance (MoF) | 2021 (Budget 2021) | Provided for recipients of the SRI Sukuk and Bond Grant Scheme for 5 years (YA 2021-2025) |

| Green Technology Financing Scheme (GTFS) | Ministry of Finance (MoF) | 2010 | Offers 60% government guarantee on financing amount; 2% rebate on interest/profit rate; accelerates green investments. |

| Value-Based Intermediation (VBI) Framework | Bank Negara Malaysia (BNM) | Nov 2019 | Redefine Islamic Financial Institutions (IFIs) operations to generate positive impacts (People, Planet, Profit); integrate ethical considerations |

5. Investor Landscape and Demand Dynamics

The investor landscape for Malaysia’s green sukuk market is characterised by a unique blend of financial stability and ethical appeal, attracting a diverse range of participants. Understanding these motivations and the existing barriers is crucial for sustained market expansion.

5.1. Motivations and Preferences of Local and International Investors

Sukuk, in general, attracts a diverse investor base, including both Muslim and non-faith-based investors. This broad appeal is primarily driven by their steady income streams and lower volatility compared to equities, offering a compelling proposition for financial stability.44 Beyond purely financial considerations, green sukuk holds significant appeal for investors seeking products that align with ethical beliefs and socially responsible principles.1 The global shift towards sustainable finance has notably boosted demand for Malaysia’s green sukuk and other ESG-compliant bonds.39

When making investment decisions, investors prioritize several key factors. Credit rating is considered highly important by 95% of investors, underscoring the demand for financial soundness. This is closely followed by the potential ESG impacts and clear use of proceeds (83%), and valuation and pricing (83%).17 Furthermore, almost 95% of investors consider an external review of the green label to be crucial, highlighting the strong demand for independent verification and transparency in green credentials.17 The consistent emphasis on both financial stability and ethical alignment indicates that investors in Malaysian sukuk are not solely driven by “green” credentials. Instead, they seek a combination of predictable returns and adherence to ethical principles. The high importance placed on external reviews further indicates a sophisticated investor base that demands verifiable impact alongside financial returns. Malaysia’s green sukuk successfully caters to this dual mandate, making it attractive to a broader investor base beyond traditional Islamic finance investors, including a growing global ESG-focused investor community. This broad appeal is crucial for scaling the market and diversifying funding sources for sustainable projects.

5.2. Institutional and Retail Investor Participation in Green Sukuk

Institutional investors, such as pension funds, insurance companies, and asset managers, are significant players in the Malaysian bond and sukuk markets. These entities often increase their allocations to fixed-income securities like sukuk to meet long-term obligations, especially in low-yield environments.44 Among local institutional investors, there is a strong preference for sovereign green bonds, with 48% expressing high interest, followed by issuances from financial institutions (37%) and corporate issuers (36%).17 This preference underscores the government’s crucial role in setting benchmarks and building confidence in the market.

To broaden the investor base, the Malaysian government has also introduced initiatives to make sukuk more accessible to individual retail investors. Examples include seasoned bonds and digital sukuk, such as the Sukuk Prihatin issued in 2020 to fund economic relief efforts.44 Internationally, Malaysia’s sukuk markets attract significant interest, particularly from the Middle East and other Islamic finance markets, a testament to Malaysia’s established leadership in sukuk issuance.6 Overall, investor demand for green and sustainability sukuk is on an upward trajectory, with 55% of investors planning to invest in these instruments in the next three years.37 The market benefits from a diversified investor base, including institutional, retail, and international players. The strong preference for sovereign issuances among local institutions indicates the government’s crucial role in de-risking the market and setting a credible standard. However, despite growing demand, a notable portion of investors still have limited exposure or understanding of sukuk and sustainability principles, indicating significant untapped potential. While Malaysia has successfully cultivated a diverse investor base, further growth requires targeted efforts to educate and engage the broader investor community, particularly conventional institutional investors who may currently perceive sukuk as an “exotic product”.35 This outreach can unlock substantial additional capital for green projects.

5.3. Barriers to Investor Engagement and Market Expansion

Despite the growing demand and supportive ecosystem, several barriers impede the full potential of Malaysia’s green sukuk market:

- Supply-Side Constraints: A critical barrier to market growth is the identified lack of a robust pipeline for eligible green projects and an insufficient supply of green bonds/sukuk.17 This indicates that, despite increasing investor interest, the availability of investable instruments often constrains demand.

- Limited Knowledge: A significant knowledge gap persists among both potential issuers and investors regarding the intricacies of sukuk and sustainability principles.18 This lack of understanding can deter new participants and limit the market’s expansion.

- Market Infrastructure and Standardisation: Some investors identify regulatory framework challenges, a lack of standardisation, and inadequate market infrastructure as primary impediments to broader adoption 18

The most frequently cited obstacles are the “lack of a pipeline for eligible projects” and “insufficient supply” of green sukuk. This points to a fundamental supply-demand imbalance. While Malaysia has established strong regulatory frameworks and incentives, the actual origination of bankable green projects and the readiness of potential issuers to tap this market are critical bottlenecks. Concurrently, knowledge gaps among both investors and issuers exacerbate this issue, making it a classic “chicken-and-egg” problem where both supply and demand need simultaneous fostering. Future growth strategies must heavily prioritise project development and issuer capacity building. This could involve government-led initiatives for identifying and preparing green projects, providing technical assistance for project structuring, and offering targeted education programs for corporates and SMEs on the benefits and process of green sukuk issuance.

6. Comparative Analysis: Malaysia’s Green Sukuk in the Global Context

Malaysia’s green sukuk market operates within a dynamic global landscape, marked by evolving competitive dynamics and ongoing efforts towards international standardisation.

6.1. Market Share and Issuance Trends Compared to Indonesia, UAE, and Saudi Arabia

Malaysia maintains its position as the largest overall sukuk issuer globally, holding a substantial 39.2% market share as of 2018.2 In 2024, the largest jurisdictions for overall sukuk issuance were Malaysia, Saudi Arabia, and Indonesia.35 Global sustainable sukuk issuance reached $11.9 billion in 2024 36, with some reports indicating $15.2 billion for ESG sukuk in the same year, representing a 14% year-on-year growth.38

While Malaysia pioneered green sukuk, the landscape for sustainable sukuk is evolving with other nations rapidly scaling up. In 2024, Saudi Arabia emerged as a significant player, accounting for 38% of global sustainable sukuk issuance, primarily driven by its banks.36 Indonesia has also taken a leading role, currently holding the largest share of the green sukuk market at 54% (approximately US

5.5billion),predominantlythroughgovernmentissuances.[4]Incontrast,Malaysiacontinuestoleadinprivate−sectorgreensukukissuance,withapproximatelyUS1 billion.4 The UAE experienced a sharp decline in issuance after a surge related to COP28 activities in 2023.47 Notable international transactions in 2024 included Indonesia’s 30-year green sukuk and a $5 billion issue from Saudi Arabia.35 While Malaysia maintains its overall sukuk dominance, the green/sustainable sukuk segment reveals a more nuanced competitive landscape. Saudi Arabia’s emergence as a significant player in

sustainable sukuk and Indonesia’s leadership in government green sukuk indicate that while Malaysia pioneered the instrument, other nations are rapidly scaling up, particularly in sovereign issuances. Malaysia’s continued strength lies in its robust private sector green sukuk issuances. This dynamic suggests that Malaysia needs to continue leveraging its private sector expertise and adaptable regulatory framework to maintain its edge. There is also an opportunity for Malaysia to foster more sovereign or quasi-sovereign green sukuk to complement its private sector leadership, ensuring it remains at the forefront of all segments of the sustainable Islamic finance market.

Table 4: Comparative Green/Sustainable Sukuk Issuance Volumes (Malaysia vs. Key Markets, 2024-2025)

| Country/Entity | Issuance Type | Volume (USD/RM billion) | Year | Market Share/Notable Issuances |

| Global Total | Overall Sukuk | ~$180B | 2024 | On pace for $1T outstanding in the next few years |

| Global Total | Overall Sukuk | $193.4B | 2024 | Slight decline from $197.8B in 2023; projected $190-200B in 2025 |

| Global Total | Green/Sustainable Sukuk | ~$11B (Q3) | 2024 | Projected $30-50B towards SDGs by 2025 |

| Global Total | Sustainable Sukuk | $11.9B | 2024 | Projected $10-12B in 2025 |

| Global Total | ESG Sukuk | $15.2B | 2024 | 14% Y-o-Y growth; 1.8% of total ESG bond issuance; 6.1% of total sukuk issuance |

| Malaysia | Overall Sukuk | 39.2% market share | 2018 | Largest sukuk issuer globally |

| Malaysia | SRI Sukuk (cumulative) | RM18.92B | 2022 | Since the SRI Sukuk Framework (2014) |

| Malaysia | SRI Sukuk (annual) | RM10.58B (2022); RM27.61B (2023) | 2022, 2023 | Significant growth |

| Malaysia | Green Sukuk (private sector) | ~$1B | Recent | Leads in private-sector issuance |

| Malaysia | Sovereign Sustainability Sukuk | USD1.3B | 2021 | World’s first sovereign USD Sustainability Sukuk |

| Indonesia | Green Sukuk | 54% market share (~$5.5B) | Recent | Largest share, predominantly government issuance; 30-year green sukuk in 2024 |

| Saudi Arabia | Sustainable Sukuk | 38% of the total | 2024 | Driven by Saudi banks; $5B issue in 2024 |

| UAE | ESG Sukuk | $3.9B (9M) | 2023 | Largest issuance base in 9M 2023; sharp drop after COP28 surge |

6.2. Regulatory Framework Comparisons and Best Practices

Malaysia’s regulatory environment for sustainable Islamic finance stands out for its cohesion and structured approach. The country benefits from a comprehensive legal framework under the Islamic Financial Services Act 2013, with integrated supervision by Bank Negara Malaysia and the Securities Commission.48 This unified oversight ensures enforceable Shari’ah compliance and robust support for financial innovation.48

In contrast, Indonesia’s regulatory environment is characterised by fragmented oversight between its Financial Services Authority (OJK) and the National Shari’ah Council (DSN-MUI), which can lead to legal uncertainty and limited enforcement of Shari’ah principles.48 The explicit comparison with Indonesia highlights Malaysia’s “more cohesive and structured legal framework” and “centralised Shari’ah governance.” This regulatory clarity and consistency are a significant competitive advantage, as they reduce uncertainty for both issuers and investors, thereby fostering innovation and market confidence. The global push for standardisation further validates Malaysia’s early efforts in establishing robust frameworks. Malaysia’s regulatory maturity is a key differentiator in the global sustainable Islamic finance landscape. It positions the country as a model for other jurisdictions seeking to develop similar markets. Continued leadership will involve actively participating in and shaping global standardisation efforts to ensure its frameworks remain aligned with international best practices and continue to attract a wider global investor base.

Globally, supportive regulatory frameworks and taxonomies, such as those in Malaysia, Indonesia, and the UAE, are recognised as crucial for the growth of the green sukuk market.18 Recent efforts to standardise the green sukuk market include the publication of guidance on green, social, and sustainability sukuk in April 2024. This guidance, jointly prepared by the Islamic Development Bank, the International Capital Market Association, and the London Stock Exchange, aims to bridge the gap between sukuk and conventional green bonds, making sukuk more “familiar and tested” to attract a broader base of traditional institutional investors.3

7. Challenges and Future Outlook for Malaysia’s Green Sukuk Market

While Malaysia has established a pioneering role in green sukuk, the market faces specific challenges that must be addressed to ensure sustained growth and enhanced global impact.

7.1. Addressing Supply-Side Constraints and Knowledge Gaps

A critical barrier to the continued growth of Malaysia’s green sukuk market is the identified lack of a robust pipeline for eligible green projects and an insufficient supply of green sukuk.17 This indicates that despite growing investor demand, the availability of investable instruments often constrains market expansion. Concurrently, a significant knowledge gap persists among both potential issuers and investors regarding the intricacies of sukuk and sustainability principles, which can deter new participants.18 Underwriters, for instance, emphasise the need for a larger pipeline of green projects to spur more issuances.17 The most frequently cited obstacles are the “lack of a pipeline for eligible projects” and “insufficient supply” of green sukuk. This points to a fundamental supply-demand imbalance. While Malaysia has established strong regulatory frameworks and incentives, the actual

origination of bankable green projects and the readiness of potential issuers to tap this market are critical bottlenecks. Concurrently, knowledge gaps among both investors and issuers exacerbate this issue, making it a classic “chicken-and-egg” problem where both supply and demand need simultaneous fostering. To overcome these challenges, there is a clear necessity for capacity enhancement and increased awareness initiatives to bridge the knowledge gap and expand the market.18

7.2. Evolving Regulatory Standards and International Harmonisation

The landscape of sustainable finance regulation is continuously evolving. Positive steps towards standardisation, such as the new guidance on green, social, and sustainability sukuk published in April 2024 by the Islamic Development Bank, ICMA, and the London Stock Exchange, aim to make sukuk more accessible and “familiar” to a broader base of conventional investors.3 However, the sukuk market also faces potential disruption from evolving regulatory standards, notably the proposed Accounting and Auditing Organisation for Islamic Financial Institutions (AAOIFI) Standard 62. If implemented as drafted, this standard could significantly alter the structural foundation of sukuk, potentially shifting focus from contractual obligations to purely asset-based structures. This might raise concerns about credit risk, introduce legal complexities, and potentially increase the cost of structuring sukuk, especially if it mandates Shari’ah law as the governing framework over English law in international transactions.36 While global standardisation efforts are generally beneficial for market expansion, the proposed AAOIFI Standard 62 introduces a potential source of uncertainty and disruption. A shift in structural requirements or a mandatory preference for Shari’ah law over English law in international transactions could introduce significant legal and cost complexities, potentially impacting market liquidity and investor confidence. This highlights the delicate balance between Shari’ah authenticity and market practicality.

7.3. Strategic Pathways for Sustained Growth and Innovation

To sustain and amplify its pioneering role, Malaysia must pursue strategic pathways focused on diversification, collaboration, and continuous innovation. There is a pressing need to optimize diverse sukuk structures to catalyze funding for a just and orderly transition, particularly for emerging and developing economies facing significant financing requirements for sustainable infrastructure.39 Attracting multilateral capital is also crucial; offering flexibilities for multilateral development banks (MDBs) and qualified development financial institutions (DFIs) to issue Ringgit-denominated sukuk can unlock wider funding sources for both government and private sector projects.39

Strengthening international partnerships is essential to unlock green investment opportunities and leverage Asia’s inherent strength in sustainability bond issuance by synergising with Malaysia’s expertise in Islamic finance.39 The outlined strategic pathways suggest a move beyond purely domestic initiatives to a more globally integrated approach. The specific mention of MDBs/DFIs issuing Ringgit-denominated sukuk indicates a focus on attracting diverse capital sources and strengthening local currency markets, which is vital for long-term financial resilience. This multi-pronged strategy aims to address the massive climate financing gap in Asia. Experts project that green and sustainability sukuk could collectively raise between $30 billion and $50 billion towards Sustainable Development Goals (SDGs) by 2025, indicating significant untapped potential within this market.18

Conclusion

Malaysia’s journey in pioneering green sukuk exemplifies a strategic and deeply rooted commitment to sustainable Islamic finance. By leveraging its robust Islamic finance infrastructure and a proactive, adaptive regulatory environment, Malaysia has successfully integrated Shari’ah principles with global sustainability objectives. The market has demonstrated tangible impacts through significant issuances in renewable energy and green building projects, contributing directly to national climate targets and the Sustainable Development Goals. This leadership has not only positioned Malaysia as a global hub for Islamic finance innovation but also as a model for other emerging economies seeking to bridge their climate financing gaps. The nation’s ability to create a cohesive regulatory ecosystem, coupled with targeted financial incentives and a philosophical commitment to value-based intermediation, has been fundamental to its success.

Recommendations

To sustain and amplify its pioneering role, Malaysia should focus on the following strategic recommendations:

- Enhance Project Pipeline Development:

- Action: Implement proactive government and private sector collaboration mechanisms to identify, develop, and de-risk a steady stream of eligible green projects across diverse sectors, including renewable energy, energy efficiency, clean transportation, sustainable waste management, and green buildings. This should involve technical assistance for project structuring and feasibility studies to ensure bankability.

- Rationale: The primary constraint to market growth is the insufficient supply of investable green projects. A robust pipeline is essential to meet growing investor demand and fully leverage the established regulatory and incentive frameworks.

- Strengthen Capacity Building and Market Awareness:

- Action: Develop and implement targeted education and awareness programs for potential issuers, particularly small and medium enterprises (SMEs) and those in hard-to-abate sectors, on the benefits and process of green sukuk issuance. Concurrently, expand outreach to conventional institutional investors globally to demystify sukuk and highlight its dual financial and ethical appeal.

- Rationale: Addressing knowledge gaps among both issuers and investors is crucial for broadening market participation and unlocking untapped capital. Increased awareness can reduce perceived complexities and facilitate greater adoption.

- Actively Engage in Global Standardization and Harmonization Efforts:

- Action: Malaysia should continue to play a leading role in international forums and working groups focused on standardising green and sustainable sukuk. This includes actively participating in discussions around evolving standards, such as AAOIFI Standard 62, to ensure that global frameworks support market growth while preserving Shari’ah authenticity and practical applicability in international transactions.

- Rationale: Proactive engagement in shaping global standards is vital to maintain Malaysia’s competitive edge, prevent regulatory fragmentation, and ensure its frameworks remain aligned with international best practices, thereby attracting a wider global investor base.

- Foster Diversification of Issuers and Product Structures:

- Action: Encourage a broader range of issuers, including more sovereign and quasi-sovereign entities, to complement Malaysia’s strong private sector leadership in green sukuk. Explore and promote innovative sukuk structures, including those tailored for “transition finance” and digital sukuk, to cater to evolving market needs and investor preferences.

- Rationale: Diversifying the issuer base and product offerings will enhance market depth, resilience, and attractiveness, enabling green sukuk to finance a wider spectrum of sustainable development initiatives and address the massive climate financing gap in Asia.

By systematically addressing these recommendations, Malaysia can reinforce its pioneering role, overcome existing challenges, and further solidify its position as a global lighthouse for sustainable Islamic finance, contributing significantly to both national development and global climate action.

Works cited

- Helping Malaysia develop the green sukuk market – The World Bank, accessed August 18, 2025, https://thedocs.worldbank.org/en/doc/21c2fb7dfb189f10a0503004757b03f4-0340012022/original/Case-Study-Malaysia-Green-Sukuk-Market-Development.pdf

- green sukuk issuance: a case study of public university in malaysia – ResearchGate, accessed August 18, 2025, https://www.researchgate.net/publication/390534343_GREEN_SUKUK_ISSUANCE_A_CASE_STUDY_OF_PUBLIC_UNIVERSITY_IN_MALAYSIA

- Guidance on Green, Social and Sustainability Sukuk – The International Capital Market Association » ICMA, accessed August 18, 2025, https://www.icmagroup.org/assets/documents/Sustainable-finance/ICMA-IsDB-LSEG-Guidance-on-Green-Social-and-Sustainability-Sukuk-April-2024.pdf

- A comparative analysis of green sukuk and green bonds | International Journal of Islamic and Middle Eastern Finance and Management – Emerald Insight, accessed August 18, 2025, https://www.emerald.com/imefm/article/doi/10.1108/IMEFM-12-2024-0609/1251494/A-comparative-analysis-of-green-sukuk-and-green

- Helping Malaysia Develop the Green Sukuk Market : Facilitating Sustainable Financing – Case Study – World Bank Documents and Reports, accessed August 18, 2025, https://documents.worldbank.org/en/publication/documents-reports/documentdetail/586751546962364924/helping-malaysia-develop-the-green-sukuk-market-facilitating-sustainable-financing-case-study

- Green sukuk and development of green Islamic finance in Malaysia – Durham Research Online (DRO), accessed August 18, 2025, https://durham-repository.worktribe.com/OutputFile/1241220

- Facilitating SDGs with Islamic Finance (Part 1) Malaysia’s Leadership in Sukuk | IFAC, accessed August 18, 2025, https://www.ifac.org/knowledge-gateway/discussion/facilitating-sdgs-islamic-finance-part-1-malaysia-s-leadership-sukuk

- Malaysia Renewable Energy Roadmap (MyRER) – SEDA, accessed August 18, 2025, https://www.seda.gov.my/reportal/myrer/

- Asia Climate Pledges – Country Profiles 2025 – Malaysia, accessed August 18, 2025, https://ca1-clm.edcdn.com/publications/Asia-Climate-Pledges-Country-Profiles-2025-Malaysia.pdf?v=1743554176

- NET ZERO BY 2050?, accessed August 18, 2025, https://www.tnb.com.my/assets/newsclip/19052025g.pdf

- Economic and environmental analysis of Malaysia’s 2025 renewable and sustainable energy targets in the generation mix – PubMed Central, accessed August 18, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11096703/

- Malaysia – Renewable Energy – International Trade Administration, accessed August 18, 2025, https://www.trade.gov/country-commercial-guides/malaysia-renewable-energy

- Malaysia (Country) | Net Zero Tracker, accessed August 18, 2025, https://zerotracker.net/countries/malaysia-cou-0164

- NEM 3.0 – Renewable Energy Malaysia – SEDA, accessed August 18, 2025, https://www.seda.gov.my/reportal/nem/

- Sustainable and Responsible Investment Sukuk Framework – An Overview – Securities Commission Malaysia, accessed August 18, 2025, https://www.sc.com.my/api/documentms/download.ashx?id=84491531-2b7e-4362-bafb-83bb33b07416

- Driving Greater Growth in Sustainable and Responsible Investment – Enabling a More Relevant, Efficient and Diversified Market | Securities Commission Malaysia, accessed August 18, 2025, https://www.sc.com.my/annual-report-2022/enabling-a-more-relevant-efficient-and-diversified-market/driving-greater-growth-in-sustainable-and-responsible-investment

- Green Bond Market Survey for Malaysia: Insights on the …, accessed August 18, 2025, https://www.adb.org/sites/default/files/publication/838756/green-bond-market-survey-malaysia.pdf

- THE POTENTIAL GROWTH AND FUTURE TRENDS OF GREEN SUKUK AS A TOOL FOR SUSTAINABLE FINANCING – United Nations Development Programme, accessed August 18, 2025, https://www.undp.org/sites/g/files/zskgke326/files/2025-05/undp-kfh-green-sukuk-tool-for-sustainable-financing.pdf

- World’s First Sovereign U.S. Dollar Sustainability Sukuk Issuance by The Government of Malaysia – Kementerian Kewangan, accessed August 18, 2025, https://www.mof.gov.my/portal/en/news/press-release/world-s-first-sovereign-u-s-dollar-sustainability-sukuk-issuance-by-the-government-of-malaysia

- SRI Sukuk – Islamic Bonds – Capital Markets Malaysia, accessed August 18, 2025, https://www.capitalmarketsmalaysia.com/public-sri-sukuk/

- SRI Grant Scheme expanded to SC’s SRI-linked Sukuk Framework | Skrine, accessed August 18, 2025, https://www.skrine.com/insights/alerts/august-2022/sri-grant-scheme-expanded-to-sc%E2%80%99s-sri-linked-sukuk

- Green Sukuk: A New Legacy for Green Sprouts? – Saturna Capital, accessed August 18, 2025, https://www.saturna.com/sites/saturna.com/files/2020-01/WP_Green_Sukuk-20191115-web.pdf

- ‘Second Opinion’ on Tadau Energy’s Green Sukuk Framework – CICERO Research Archive, accessed August 18, 2025, https://pub.cicero.oslo.no/cicero-xmlui/bitstream/handle/11250/2720351/tadau_energy_2017.pdf

- RAM Ratings affirms Tadau Energy’s AA3/Stable SRI Sukuk rating – RAM Holdings Berhad, accessed August 18, 2025, https://www.ram.com.my/pressrelease/?prviewid=6723

- Issuance – MARC, accessed August 18, 2025, https://www.marc.com.my/group/issuance/

- quantum solar park (semenanjung) sdn bhd – 2024 – MARC ONLINE, accessed August 18, 2025, https://online.marc.com.my/Home/ViewCar?aid=60538900469707

- quantum solar park (semenanjung) sdn bhd – 2025 – MARC ONLINE, accessed August 18, 2025, https://online.marc.com.my/Home/ViewCar?aid=60538900470070

- PNB Merdeka Ventures Sdn Berhad – Green Sukuk – MSFI, accessed August 18, 2025, https://www.msfi.com.my/pnb-merdeka-ventures-sdn-berhad-green-sukuk/

- Merdeka 118 – Wikipedia, accessed August 18, 2025, https://en.wikipedia.org/wiki/Merdeka_118

- Merdeka 118 Tower – Terrapin Bright Green, accessed August 18, 2025, https://www.terrapinbrightgreen.com/blog/2024/05/pnb118/

- Published Reports – MARC ONLINE, accessed August 18, 2025, https://online.marc.com.my/Home/PublishedCar?coid=SINARKAMIRI

- Power plant profile: Sungai Siput Solar PV Park, Malaysia, accessed August 18, 2025, https://www.power-technology.com/data-insights/power-plant-profile-sungai-siput-solar-pv-park-malaysia/

- World’s first sovereign US Dollar Sustainability Sukuk issuance by The Government of Malaysia | LegalOne, accessed August 18, 2025, https://www.legaloneglobal.com/deal/World%E2%80%99s-first-sovereign-US-Dollar-Sustainability-Sukuk-issuance-by-The-Government-of-Malaysia-1654521755542

- Ministry of Finance Malaysia Sukuk Allocation and Impact Report 2022 | Market Report | The Knowledge Portal, accessed August 18, 2025, https://ukifc.com/2024/01/22/ministry-of-finance-malaysia-sukuk-allocation-and-impact-report-2022-market-report-the-knowledge-portal/

- State of the Sukuk Market and Prospects for Growth – World Bank Blogs, accessed August 18, 2025, https://blogs.worldbank.org/en/allaboutfinance/state-of-the-sukuk-market-and-prospects-for-growth

- SUKUK | Business Insight – March 2025 – SAB, accessed August 18, 2025, https://www.sab.com/en/corporate/business-insight/2025/march-home/sukuk/

- Green and Sustainability Sukuk Report 2024: Crossing Borders, accessed August 18, 2025, https://www.globalethicalfinance.org/2024/11/28/green-and-sustainability-sukuk-report-2024-crossing-borders/

- Why ESG sukuk has the wind in its sails – LSEG, accessed August 18, 2025, https://www.lseg.com/en/insights/why-sustainable-sukuk-has-wind-in-its-sails

- Deputy Governor’s Keynote Address at the IFN Asia Forum 2024 …, accessed August 18, 2025, https://www.bnm.gov.my/-/dgaz-spch-ifnaf

- vbi report 2023 – AIBIM, accessed August 18, 2025, https://aibim.com/value-based-intermediation/VBI-Report-2023.pdf

- Incentives – SRI Sukuk and Bond Grant Scheme – MSFI, accessed August 18, 2025, https://www.msfi.com.my/incentives-sri-sukuk-and-bond-grant-scheme/

- THE GOVERNMENT OF MALAYSIA SDG SUKUK FRAMEWORK, accessed August 18, 2025, https://financialmarkets.bnm.gov.my/data-download-documents/1848

- BNM issues Guidance Document on Value-Based Intermediation Framework for Islamic Financial Institutions – Skrine – Advocates & Solicitors, accessed August 18, 2025, https://www.skrine.com/insights/alerts/november-2019/bnm-issues-guidance-document-on-value-based-interm

- Investor Sentiment and Demand for Bonds and Sukuk in Malaysia …, accessed August 18, 2025, https://www.bixmalaysia.com/learning-center/articles-tutorials/investor-sentiment-and-demand-for-bonds-and-sukuk-in-malaysia

- Malaysian Sukuk: A Superior Alternative to Traditional Bonds | Franklin Templeton APAC, accessed August 18, 2025, https://www.ftinstitutionalapac.com/articles-apac/inst/malaysian-sukuk-superior-alternative-to-traditional-bonds

- Green and Sustainability Sukuk Update 2024 | LSEG, accessed August 18, 2025, https://www.lseg.com/content/dam/data-analytics/en_us/documents/reports/lseg-green-and-sustainability-sukuk-2024-report.pdf

- Green and Sustainability Sukuk Update Report 2023 – LSEG, accessed August 18, 2025, https://www.lseg.com/content/dam/data-analytics/en_us/documents/reports/lseg-green-and-sustainability-sukuk-update-2023-report.pdf

- Regulatory Frameworks In Islamic Fintech: Comparative Insights From Indonesia and Malaysia – eJurnal UNG, accessed August 18, 2025, https://ejurnal.ung.ac.id/index.php/jalrev/article/download/30447/11534