Navigating Malaysia’s Sustainable Future: Understanding the Synergy of ESG, SDGs, and CSR

Executive Summary: Navigating Malaysia’s Sustainable Future – The Synergy of ESG, SDGs, and CSR

The global business landscape is undergoing a profound transformation, driven by increasing demands for corporate accountability and sustainable practices. At the forefront of this shift are Environmental, Social, and Governance (ESG) criteria, the United Nations Sustainable Development Goals (SDGs), and Corporate Social Responsibility (CSR). While distinct in their origins and primary applications, these frameworks are deeply interconnected and collectively form the bedrock of modern sustainable business. For Malaysia, a nation experiencing rapid economic growth alongside environmental and social challenges, embracing these principles is not merely a matter of compliance but a strategic imperative. The country’s proactive regulatory landscape, coupled with the accelerating adoption of these principles by its corporate sector, particularly Small and Medium-sized Enterprises (SMEs), underscores their critical role in fostering long-term resilience, attracting responsible investment, and driving value creation. This report delves into each concept, clarifies their synergies and distinctions, and provides a detailed overview of Malaysia’s robust commitment and progress in integrating sustainability into its national and corporate agenda.

Introduction: The Global Imperative for Sustainable Business

An undeniable global shift towards sustainable practices characterises the contemporary business environment. This movement is fueled by a confluence of factors, including escalating stakeholder demands, increasing regulatory pressures, and the palpable impacts of climate change and widening social inequalities. Businesses today are no longer solely evaluated on their financial performance; their environmental stewardship, social impact, and governance integrity have become equally, if not more, critical metrics of success. This broader assessment reflects a fundamental redefinition of corporate purpose, moving beyond profit maximisation to encompass a wider responsibility to society and the planet.

The evolution of corporate responsibility highlights this profound change. Historically, corporate engagement with societal issues was often limited to philanthropic initiatives, seen as discretionary acts of charity. However, seminal works, such as Howard R. Bowen’s 1953 publication “Social Responsibilities of the Businessman”, began to expand this view, positing that business leaders held obligations beyond mere financial success. Over subsequent decades, particularly during the heightened social and environmental consciousness of the 1960s and 1970s, the concept of Corporate Social Responsibility (CSR) expanded to encompass ethical labour practices and environmental stewardship. The 1980s and 1990s saw a surge in corporate sustainability, further embedding these considerations into corporate ethos. By the 21st century, the advent of globalisation and the digital revolution brought unprecedented scrutiny and connectivity, transforming CSR from a voluntary add-on into a central element of corporate governance and a strategic necessity for long-term viability. This progression highlights that understanding ESG, SDGs, and CSR is not only beneficial for modern enterprises but also essential for their enduring relevance and competitive standing.

Within this global context, Malaysia plays a pivotal role in the regional and global sustainability agenda. The nation’s unique trajectory of rapid economic growth has, at times, contributed to environmental degradation and social inequality. This distinct context necessitates robust sustainability frameworks and proactive measures, making Malaysia’s journey in integrating ESG, SDGs, and CSR particularly instructive.

Understanding the Core Concepts

To fully grasp the contemporary landscape of sustainable business, it is essential to establish a clear understanding of Corporate Social Responsibility (CSR), the Sustainable Development Goals (SDGs), and Environmental, Social, and Governance (ESG) principles. While often used interchangeably, these concepts possess distinct characteristics and roles within the broader sustainability ecosystem.

Corporate Social Responsibility (CSR): Beyond Philanthropy

Corporate Social Responsibility (CSR) is a business model that enables a company to be socially accountable—to itself, its stakeholders, and the broader public. This accountability extends across economic, social, and environmental dimensions of its operations. CSR goes beyond mere compliance with regulatory requirements, encompassing actions that proactively further social good, often extending beyond the direct financial interests of the firm. At its core, CSR reflects a business’s responsibility to all its stakeholders, including employees, customers, suppliers, and the communities in which it operates, rather than being solely focused on shareholders.

The genesis of CSR can be traced back to the early 20th century, when philanthropic initiatives by industrial magnates began to emerge. However, it was Howard R. Bowen’s 1953 publication, “Social Responsibilities of the Businessman,” that significantly advanced the concept, expanding it beyond simple philanthropy to include ethical labour practices, environmental stewardship, and community engagement. Throughout the 1960s and 1970s, amidst growing social and ecological consciousness, CSR began to incorporate broader societal concerns, leading to its gradual integration into corporate governance. The 1980s and 1990s witnessed a surge in corporate sustainability and ethical business practices, further embedding CSR into the corporate ethos. By the 21st century, globalisation and the digital revolution brought unprecedented scrutiny and connectivity, solidifying CSR as a central element of corporate governance. This historical progression illustrates that CSR has evolved from a discretionary form of corporate giving to a pervasive philosophy influencing policy and structure, marking a fundamental shift in how businesses perceive their role in society.

Key characteristics of CSR include the integration of ethical values such as honesty, integrity, fairness, and respect across all aspects of operations. It mandates that companies recognise and uphold the dignity, rights, and welfare of their employees, customers, and the communities in which they operate. Environmental stewardship is a crucial component, alongside active contributions to broader societal goals, which can manifest through philanthropic activities, community development projects, support for educational initiatives, or investments in healthcare for underprivileged communities. CSR is typically driven by a company’s internal values and ethical commitments to “doing the right thing”. This internal drive and the shift from discretionary acts to a strategic necessity underscore that authentic CSR is deeply embedded in a company’s culture and purpose. This distinction is vital, as it sets genuine commitment apart from mere compliance or superficial public relations efforts, suggesting that a strong, values-based approach is essential for building long-term impact and earning stakeholder trust.

Sustainable Development Goals (SDGs): A Universal Blueprint for Progress

The Sustainable Development Goals (SDGs) represent a universal call to action, adopted by all 193 United Nations (UN) member states in 2015 as part of the 2030 Agenda for Sustainable Development. Their overarching purpose is to end poverty, protect the planet, and improve the lives and prospects of everyone, everywhere, by 2030. These goals collectively aim for “peace and prosperity for people and the planet,” while specifically addressing critical global challenges such as climate change and the preservation of oceans and forests.

The SDGs comprise 17 interconnected goals, each with specific targets (169 in total) and indicators to measure progress. These goals cover a vast spectrum of global challenges, from socio-economic development to environmental protection, and include:

- Goal 1: No Poverty: Ending poverty in all its forms everywhere, including extreme poverty (living on less than USD 2.15 a day) and ensuring access to basic needs.

- Goal 2: Zero Hunger: Achieving food security, improving nutrition, and promoting sustainable agriculture.

- Goal 3: Good Health and Well-Being: Ensuring healthy lives and promoting well-being for all ages, with indicators like life expectancy, child and maternal mortality.

- Goal 4: Quality Education: Ensuring inclusive and equitable quality education and promoting lifelong learning opportunities for all, including attendance and completion rates.

- Goal 5: Gender Equality: Achieving gender equality and empowering all women and girls, addressing issues like forced marriage and female genital mutilation.

- Goal 6: Clean Water and Sanitation: Ensuring availability and sustainable management of water and sanitation for all, including safely managed drinking water and wastewater treatment.

- Goal 7: Affordable and Clean Energy: Ensuring access to affordable, reliable, sustainable, and modern energy for all.

- Goal 8: Decent Work and Economic Growth: Promoting sustained, inclusive, and sustainable economic growth, full and productive employment, and decent work for all.

- Goal 9: Industry, Innovation and Infrastructure: Building resilient infrastructure, promoting inclusive and sustainable industrialisation, and fostering innovation.

- Goal 10: Reduced Inequalities: Reducing inequality within and among countries.

- Goal 11: Sustainable Cities and Communities: Making cities and human settlements inclusive, safe, resilient, and sustainable.

- Goal 12: Responsible Consumption and Production: Ensuring sustainable consumption and production patterns.

- Goal 13: Climate Action: Taking urgent action to combat climate change and its impacts.

- Goal 14: Life Below Water: Conserving and sustainably using the oceans, seas, and marine resources for sustainable development.

- Goal 15: Life on Land: Protecting, restoring, and promoting sustainable use of terrestrial ecosystems, sustainably managing forests, combating desertification, and halting biodiversity loss.

- Goal 16: Peace, Justice, Strong Institutions: Promoting peaceful and inclusive societies for sustainable development, providing access to justice for all, and building effective, accountable, and inclusive institutions at all levels.

- Goal 17: Partnerships for the Goals: Strengthening the means of implementation and revitalising the global partnership for sustainable development.

The global significance of the SDGs lies in their provision of a common language and a comprehensive framework for governments, businesses, and civil society to align their efforts towards a sustainable future. The fact that these goals are “often interconnected” means that progress in one area, such as affordable and clean energy (Goal 7), can directly contribute to others, like climate action (Goal 13) or decent work and economic growth (Goal 8). This integrated approach encourages a collective, systemic change, moving beyond isolated initiatives to a shared global agenda. For businesses, aligning operations with SDGs offers a clear pathway to demonstrate broader societal impact beyond their direct value chain. This alignment can significantly enhance corporate reputation, attract purpose-driven talent, and open new markets related to sustainable solutions, providing a globally recognised standard against which corporate sustainability efforts can be measured and communicated, transcending national boundaries.

Environmental, Social, and Governance (ESG): The Investment Lens

Environmental, Social, and Governance (ESG) is a comprehensive framework that has become a cornerstone in evaluating an organisation’s sustainable and ethical performance. It is an international acronym widely used in the financial community to guide investor decisions and influence corporate strategy. ESG goes beyond traditional financial metrics, assessing how a company manages its risks and opportunities related to environmental, social, and governance factors, thereby enriching the analysis of its future financial performance and identifying less risky investments. This framework implies a focus not just on generating profits, but critically, on how those profits are earned from a sustainable development perspective.

The ESG framework is structured around three interdependent pillars:

- Environmental (E): This pillar scrutinises a company’s impact on the natural environment and its commitment to ecological sustainability. Key criteria include the company’s direct and indirect greenhouse gas (GHG) emissions, its electricity consumption (with a focus on renewable energy sources), waste generation and management practices, impacts and dependencies on biodiversity, efforts in water conservation, and strategies for mitigating climate change. It also assesses how responsibly the company uses resources and manages its supply chain from an environmental perspective.

- Social (S): This pillar measures the company’s impact on its stakeholders throughout its value chain. This includes its relationships with and treatment of employees, customers, suppliers, and local communities. Specific criteria encompass workplace accident rates, staff training and development, the quality of social dialogue, initiatives promoting gender, BIPOC (Black, Indigenous, and People of Colour), and LGBTQ+ inclusivity, employee engagement, data protection and privacy measures, adherence to human rights and labour standards, product safety, and broader community involvement.

- Governance (G): This pillar addresses the quality and integrity of a company’s leadership, internal controls, and overall governance structures. It encompasses policies and procedures governing leadership effectiveness, the composition and diversity of the board of directors, executive compensation practices, the structure and oversight of audit committees, shareholder rights, anti-bribery and anti-corruption measures, lobbying activities, political contributions, and the establishment of robust whistleblower programs. In the Malaysian context, governance also explicitly encompasses the management and understanding of climate risks, as well as their integration into internal controls, business strategies, risk appetite frameworks, and enterprise-wide risk management.

The primary purpose of ESG criteria is to guide investor decisions. Financial institutions and investors are increasingly using ESG performance to assess a company’s environmental and social impact, which in turn informs their analysis of its future financial performance. Companies demonstrating strong ESG performance are perceived as less risky, better positioned for long-term success, and more likely to attract responsible investment. This enhances their credibility and trust among investors. The financial market’s increasing use of ESG criteria means that robust ESG performance directly impacts a company’s valuation, access to capital, and long-term financial resilience. This transforms sustainability from a purely ethical consideration into a strategic imperative for financial performance and competitive advantage, making it a non-negotiable aspect of modern business strategy. ESG reporting is the formalised process by which companies communicate their performance and impact using these criteria, providing transparency and accountability to stakeholders.

The Interconnected Web: Synergies and Distinctions

While Corporate Social Responsibility (CSR), Sustainable Development Goals (SDGs), and Environmental, Social, and Governance (ESG) are distinct concepts, they are profoundly interconnected and form a cohesive, evolving approach to sustainability. Understanding their individual roles and collective synergy is crucial for any organisation aiming to drive meaningful impact.

Interconnections

CSR is often regarded as the foundational concept, serving as the predecessor to ESG. It laid the initial groundwork by compelling businesses to consider their broader impact on society, employees, shareholders, and other stakeholders, fostering a general ethical commitment to “doing the right thing”. This moral and values-driven approach of CSR provides the substance and genuine intent behind a company’s sustainability efforts.

The Sustainable Development Goals (SDGs) provide the overarching global framework and specific targets for sustainable development. CSR initiatives directly contribute to achieving these global goals by addressing specific social and environmental challenges. For instance, a company’s community development programs, a core aspect of CSR, can directly support SDG 1 (No Poverty) or SDG 4 (Quality Education). Similarly, environmental initiatives under CSR contribute to goals such as SDG 13 (Climate Action) and SDG 6 (Clean Water and Sanitation). The SDGs offer a universal blueprint, allowing corporate actions to align with a globally recognised agenda for a better world.

ESG then functions as the measurable application of these principles. It focuses on specific, quantifiable actions that can be implemented to realise the broader goals of CSR and contribute tangibly to the SDGs. ESG metrics provide businesses with the necessary tools to measure and manage their contributions to sustainability, ensuring that corporate actions are aligned with the ambitious targets of the SDGs. Companies demonstrating strong ESG performance are inherently more likely to contribute effectively to various SDG targets, such as reducing carbon emissions (SDG 13) or promoting fair labour practices (SDG 8). This relationship means that the core SDG goals, particularly those mentioned in international agreements like the Paris Climate Agreement, are directly linked to the actions and thinking embedded within both CSR and ESG frameworks.

Ultimately, CSR, SDGs, and ESG are not isolated concepts. Instead, they represent interconnected and complementary pathways, all collectively striving towards the overarching goal of sustainability for both people and the planet. This dynamic relationship highlights that ESG serves as the critical operational and financial bridge, translating the broad ethical commitments of CSR and the universal ambitions of the SDGs into quantifiable, accountable, and investable business practices. This signifies a maturation of the sustainability agenda, moving from “good intentions” to “measurable impact” that attracts capital and drives systemic change.

Key Distinctions

While sharing significant common ground and forming a symbiotic relationship, CSR, SDGs, and ESG possess distinct interpretations and primary applications:

- Focus: CSR encompasses a company’s overall responsibility to society and its various stakeholders, often driven by its internal values. The SDGs, conversely, are global, universal goals designed for all countries and people, providing a comprehensive blueprint for planetary and societal well-being. ESG, however, is primarily focused on investors and financial stakeholders, utilising data to make informed investment decisions.

- Drivers: CSR is typically driven by a company’s internal values, ethical commitments, and a desire to enhance corporate reputation. The SDGs are driven by a global consensus and international agreements, representing a collective call to action. ESG is largely investor-driven, with financial markets increasingly using these criteria to assess risk and opportunity.

- Nature: CSR can be qualitative and historically more voluntary, encompassing a broad range of sustainable activities. The SDGs are aspirational, universal goals with 169 specific targets and indicators for global progress. ESG, in contrast, involves specific, measurable criteria that are increasingly quantifiable and, in many jurisdictions, mandatory for reporting.

- Measurement: CSR is often measured through qualitative reports, impact stories, and ad-hoc initiatives, which can be less standardised. SDGs track progress against their 169 sub-targets using specific global indicators. ESG is evaluated through precise metrics and scores, which independent rating agencies and financial institutions frequently assess to provide objective profiles of a company’s sustainability actions.

This table is invaluable for strategic business stakeholders, providing a clear, concise, and comparative overview that quickly clarifies the nuanced relationships and differences between these often-confused terms. It visually distils complex information, enhancing readability and comprehension, ensuring that the reader can easily grasp the core distinctions and how each framework contributes to the broader sustainability landscape.

Malaysia’s Commitment to Sustainability

Malaysia has demonstrated a robust and proactive commitment to integrating sustainability into its national agenda, recognising it as a crucial driver for long-term economic growth and societal well-being. This commitment is evident through a comprehensive policy landscape, the active involvement of key regulatory bodies, and a rapidly increasing rate of corporate adoption.

Policy Landscape and Regulatory Frameworks

Malaysia’s regulatory landscape has seen a significant and increasing emphasis on integrating ESG considerations across various sectors, particularly within the financial sector. A growing focus on transparency, sustainability, and ethical business practices drives this push.

The Malaysian government has taken decisive steps to address ESG issues, notably through:

- Alignment with SDGs: The Sustainable Development Goals have been strategically integrated into national policies, aligning efforts to improve healthcare, reduce poverty, and combat climate change across the nation. 1This national alignment ensures that corporate sustainability efforts contribute to a broader, globally recognised agenda.

- Malaysia Sustainable Finance Initiative (MSFI): This initiative aims to actively promote sustainable finance practices and encourage investments in sustainable development projects throughout the country. It signals a clear intent to channel capital towards environmentally and socially responsible ventures.

- MITI i-ESG Framework: The Ministry of Investment, Trade and Industry (MITI) launched the National Industry Environmental, Social and Governance (i-ESG) framework. This framework serves as a strategic roadmap to accelerate Malaysia’s achievement of sustainable development goals and facilitate the transition towards sustainable practices, particularly among manufacturing companies. The i-ESG framework is structured around four key components—standards, financing, capacity building, and market mechanism—supported by six crucial enablers: stakeholder engagement, human capital and capabilities, digitalisation, technology, financing and incentives, and policies and regulations. Phase 1.0, termed “Just Transition” (2024-2026), is specifically designed to prepare the groundwork and foster a robust ecosystem, supporting companies in embarking on their ESG journey through self-readiness assessment programs (like iESGReady and iESGStart), outreach training (‘KenalESG’), mentoring programs, and financing options. The objective is to introduce ESG concepts and prepare companies for sustainability reporting, enabling them to meet more rigorous ESG demands in Phase 2.0, “Accelerate ESG”.

Several key regulatory bodies play pivotal roles in shaping and enforcing Malaysia’s sustainability agenda:

- Bank Negara Malaysia (BNM): The central bank has been a key driver in integrating climate risk into the financial sector. It issued the Climate Change and Principle-based Taxonomy (CCPT) in 2021, developed in collaboration with the Joint Committee on Climate Change. BNM also introduced the Value-based Intermediation (VBI) initiative, encouraging financial institutions to uphold societal interests alongside profit generation. Furthermore, BNM imposes strict governance obligations on financial institutions, including requirements around internal controls, board oversight, and fair treatment of customers.

- Securities Commission (SC): The SC has introduced several significant measures to advance ESG integration within Malaysia’s capital market. This includes the National Sustainability Reporting Framework (NSRF), launched on September 24, 2024, with the primary objective of enhancing the standard of sustainability disclosures. The NSRF is being implemented via a phased and developmental approach to support widespread adoption and continuous improvement in disclosure quality. In 2022, the SC also issued the principles-based Sustainable and Responsible Investment (SRI) Taxonomy for Malaysia’s capital market, providing clarity and guidance for market participants in identifying economic activities aligned with environmental, social, and sustainability objectives. The SC also maintains a Sustainable and Responsible Investment Roadmap for the Malaysian Capital Market, further guiding the sector.

- Bursa Malaysia: As the national stock exchange operator, Bursa Malaysia has significantly elevated sustainability practices and disclosures for listed issuers. In 2022, it introduced Enhancements to Bursa’s Main Market and ACE Market Listing Requirements, mandating climate change-related disclosures within annual reports.

Public Listed Companies (PLCs) have been required to submit mandatory ESG reports since 2015, a requirement further strengthened by the 2021 revision of the Malaysian Code on Corporate Governance (MCCG). From 2025, these disclosures must align with IFRS S1 and S2 Sustainability Disclosure Standards as per the NSRF, including three years of performance metrics, targets, and assurance statements, with a phased adoption starting with large listed issuers. The Bursa Malaysia ESG Reporting Platform, launched in December 2023, offers a structured environment for submitting sustainability disclosures, ensuring strict data integrity and promoting transparency in corporate sustainability reporting. The FTSE4Good Bursa Malaysia Index further supports investors in making ESG investments and encourages best practice disclosures.

- Ministry of Corporate Affairs (MCA): As an early step, the MCA issued voluntary guidelines on Corporate Social Responsibility in 2009.

A proactive, multi-stakeholder, and phased institutionalisation of ESG and SDG frameworks characterises Malaysia’s approach to sustainability. This signifies a strategic national commitment to building a robust, resilient, and globally competitive sustainable economy, moving beyond mere regulatory compliance to fostering a deeply embedded “sustainability mindset” across industries. The coordinated efforts across government, the central bank, and the stock exchange demonstrate a sophisticated, long-term vision. This strategic and pragmatic understanding by Malaysian authorities ensures that successful ESG integration involves not just mandates but also comprehensive support, education, and a gradual transition for businesses, particularly SMEs. This collaborative and phased approach aims to ensure widespread adoption and continuous improvement, minimising immediate compliance burdens while maximising long-term impact.

Corporate Adoption and Impact

The commitment to sustainability in Malaysia extends beyond government policies, with a rapidly increasing rate of adoption among businesses, particularly Small and Medium-sized Enterprises (SMEs). This surge reflects a growing recognition of the strategic importance of ESG principles.

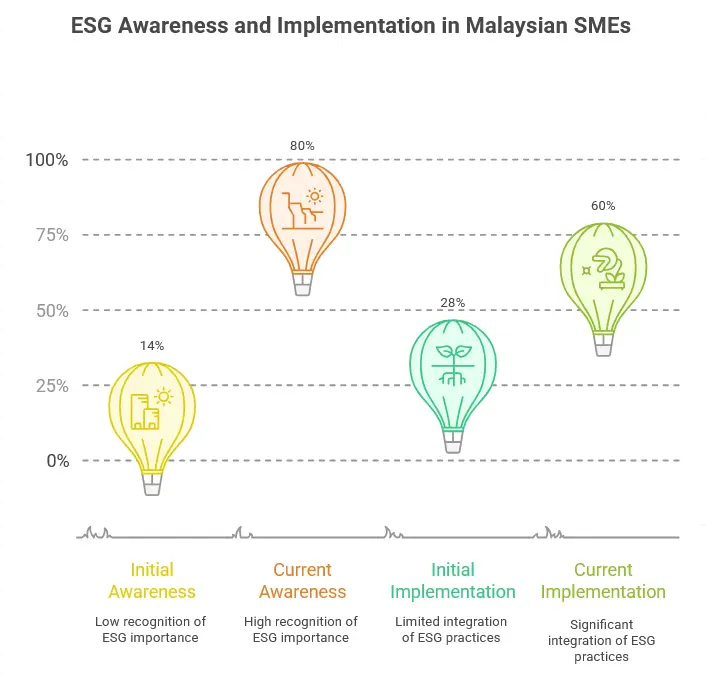

ESG awareness among Malaysian SMEs has skyrocketed from a mere 14% to an impressive 80% over the past two years, demonstrating a dramatic shift in recognising sustainability’s importance in today’s business environment. Concurrently, the proportion of SMEs that have integrated ESG practices into their operations has surged from 28% to 60% within the same period. This signifies a substantial movement from mere awareness to active implementation.

Specific sectors are advancing faster in their sustainability journeys, with manufacturing (69%) and construction (60%) emerging as leaders in ESG adoption among SMEs. The primary motivators for ESG adoption among these businesses are tangible: cost savings (53%) and market demand (51%).8 Notably, innovation has also emerged as a significant driver, now ranking among the top three reasons for ESG integration.8 This indicates that businesses are increasingly viewing ESG as a pathway to new opportunities and competitive advantage, not just a compliance burden.

The adoption of ESG practices has yielded significant financial benefits for Malaysian SMEs. A notable 38% of businesses incorporating ESG reported an increase in revenue of more than 50%, while 24% achieved cost savings exceeding 51%.8 Beyond these direct financial gains, companies also cited improved risk management and increased productivity as key benefits. These compelling figures underscore that ESG is not only about ethical responsibility but also a powerful driver of profitability and operational efficiency.

Looking ahead, the trend of ESG adoption is set to continue. A significant 52% of non-ESG adopting SMEs plan to implement ESG practices within the next two years, with 13% aiming to do so within the following year.8 This presents ample opportunities for various industry stakeholders to support their transition. Furthermore, a substantial portion (48%) of SMEs are currently self-funding their ESG initiatives, indicating a growing internal commitment to these efforts. Despite this positive momentum, a challenge has emerged: 37% of ESG adopters report feeling overwhelmed by the sheer volume of information on ESG, leading to confusion regarding appropriate sustainability standards and frameworks to follow.8 This highlights a critical need for simplified, actionable guidance and capacity building to support continued, effective adoption.

The dramatic surge in SME ESG awareness and adoption, coupled with the direct correlation to tangible financial benefits, signals a market-driven tipping point in Malaysia. This suggests that ESG is evolving beyond a top-down regulatory mandate to become a recognised pathway to competitive advantage and profitability, even for smaller enterprises. The identified challenge of “information overload” is a crucial nuance, highlighting a critical need for simplified, actionable guidance and capacity building to support continued, effective adoption.

Leading the Way: Examples of Malaysian Companies

Numerous Malaysian companies are actively demonstrating leadership in ESG integration and contributions to the SDGs, illustrating the practical application of these frameworks across diverse sectors.

- Ajinomoto Malaysia: This company has made remarkable strides in ESG integration, establishing a new 3-tier Sustainability Governance Structure. This includes a dedicated Risk Management Committee (RMC) specifically for ESG risks, as well as an ESG Committee (ESGC) tasked with conceiving and implementing ESG action plans and strategies. Their manufacturing operations were officially relocated to Bandar Enstek, recognised for its “green factory design,” establishing a new standard for enhanced productivity while fostering employee engagement.

- CIMB Group: As a prominent financial institution, CIMB has established a robust sustainability governance framework and set ambitious targets to reduce its carbon emissions and increase its use of renewable energy. The group also actively provides financing solutions for sustainable projects and champions financial inclusion and literacy among its customers.

- Sunway Group: This diversified conglomerate has set targets to reduce its carbon emissions and improve its energy efficiency. It has implemented sustainable practices across its operations, including the use of environmentally friendly building materials and promoting sustainable tourism practices.

- FedEx: Beyond its core logistics operations, FedEx has engaged in significant social and environmental initiatives in Malaysia. These initiatives include planting tree seedlings in Desaru and Balik Pulau, establishing food forests and seed banks, and engaging in extensive volunteering for vegetable planting, harvesting, and distribution in the Klang Valley, which benefits local care homes. FedEx also supports technology reuse by donating used electronic devices, highlighting its broader mission of responsible growth and social contribution.

- KPS Berhad: Through its “KPS Berhad Celik” initiative, this company has empowered over 20,000 students with educational support. Its philanthropic arm, “KPS Berhad ACT-I,” actively promotes anti-corruption awareness among future generations and instils a culture of integrity among Malaysians.

- Biocon Sdn. Bhd.: As a biopharmaceutical company, Biocon actively supports vulnerable communities and environmental causes. Their “Meals on Wheels” initiative provided food aid to flood-affected residents. At the same time, their collaboration with the IMAM Response & Relief Team brought medical support to refugee communities through the “Mobile Clinic” project. Environmentally, they partnered with Green Earth Society Johor to reduce water pollution by deploying effective microorganism mud balls.

- PKNS: This state development agency actively sustains livelihoods through programs like “Kasih PKNS” and “Ramadhan Kasih PKNS,” featuring voluntary contributions from PKNS staff and strategic partners in charity drives, sports sponsorships, and environmental conservation efforts. PKNS upholds good governance and drives environmental, social, and economic growth through its subsidiary, Worldwide Holdings Berhad.

- Flex: Established in Malaysia since 1990, Flex operates eight facilities in Penang and employs 11,000 people, making it one of the largest employers of People with Disabilities (PwDs) in the industry. With an investment of nearly RM9 million, its initiatives focus on reducing emissions, promoting community development, and enhancing workplace inclusivity. Flex upholds high ESG standards and prioritises transparency in its operations.

- MR D.I.Y. Group [M] Berhad (Yayasan MR D.I.Y.): The philanthropic arm of Malaysia’s largest home improvement retailer, established in 2023, is committed to enriching lives and uplifting communities through structured, impactful outreach in education, environmental sustainability, arts, and culture.

- CGS MY: This financial solutions provider not only offers a broad range of financial solutions but also places a strong emphasis on Corporate Social Responsibility, particularly in the areas of financial literacy and youth empowerment.

- Starbucks Malaysia: Known for innovation and inclusivity, Starbucks Malaysia launched the world’s first Starbucks Signing Store in 2016. Their sustainability efforts also include the “Upcycled Flavorlock™ Pouch Project,” which empowers women from YWCA Kuala Lumpur.

The breadth and diversity of these Malaysian company examples, spanning manufacturing, finance, retail, and community development, demonstrate that ESG and sustainability are not confined to specific industries or company sizes in Malaysia. This highlights a widespread and multi-faceted commitment, showcasing the practical and innovative application of ESG and SDG principles across the Malaysian corporate landscape, from strategic governance overhauls to grassroots community engagement.

Driving Sustainable Impact: Best Practices for Malaysian Businesses

For Malaysian businesses navigating the evolving landscape of sustainability, adopting best practices in ESG integration, SDG alignment, and CSR enhancement is crucial. These practices are not only essential for compliance but also for fostering long-term resilience, attracting investment, and building stakeholder trust.

Embed ESG in Strategy and Operations: Businesses must integrate ESG considerations deeply into their core business strategy and daily operations. This requires a strong top-down commitment, with senior leadership taking direct responsibility for driving change and fostering a “sustainability mindset” throughout the organisation. This ensures that sustainability is not an afterthought but a fundamental part of decision-making and value creation.

Set Ambitious and Aligned Goals: Companies should establish ambitious ESG goals and targets that are Specific, Measurable, Achievable, Relevant, and Time-bound (SMART). These goals must be aligned with their overall business strategy and contribute directly to the Sustainable Development Goals (SDGs). Such alignment provides a clear roadmap for action, allowing for measurable progress.

Invest in Enabling Technologies: Leveraging technology and digital tools is crucial for effectively managing ESG risks and identifying opportunities. Investing in data analytics and digital platforms enables efficient tracking, analysis, and reporting on ESG performance. These technologies facilitate swifter dissemination of information to stakeholders, enhancing transparency and responsiveness.

Engage Proactively with Stakeholders: Actively seeking feedback and engaging with all relevant stakeholders—including customers, employees, investors, and local communities—is vital. Understanding their expectations and concerns around ESG issues is fundamental for building trust, maintaining a social license to operate, and shaping future sustainability initiatives that are genuinely impactful and responsive to societal needs.

Prioritise Transparency and Comprehensive Data Disclosure:

- Provide detailed and comprehensive data on key ESG metrics, such as carbon footprint, water usage, waste management, diversity, equity, and inclusion (DEI) statistics, and governance practices.

- Accompany quantitative data with narratives and explanations to provide context, clarify significance, describe data collection methods, and explain year-over-year changes. This helps stakeholders understand the broader picture and the implications of the data.

- Be transparent about both achievements and challenges, including setbacks and failures. Reporting honestly on areas needing improvement demonstrates a commitment to continuous improvement and builds credibility with stakeholders.

- Consider obtaining third-party verification for reported data. This adds an independent layer of credibility, reassuring stakeholders of the information’s accuracy and reliability.

Develop a Consistent and Compelling Narrative (ESG Storytelling): Crafting a coherent and compelling narrative that highlights the company’s ESG journey, including triumphs, challenges, and future aspirations, is essential. Sharing specific stories about projects, partnerships, and innovations humanises the corporate message, making it more relatable and engaging for audiences. This narrative must be underpinned by measurable facts and figures, demonstrating tangible progress. Furthermore, using bold and sincere language to convey decisive actions, while avoiding equivocal terms, amplifies the impact and authenticity of the message.

Adopt an “Always-on” Communication Approach: Regularly update ESG information across all communication channels, including the company website, social media platforms, and investor relations materials. Seamlessly integrate ESG topics into all forms of corporate communications, such as press releases and annual reports. This consistent sharing of content provides stakeholders with ongoing insights into the company’s sustainability efforts.

Tailor Practices to Local Context: It is crucial to avoid blindly adopting ESG models from other countries. Instead, businesses should tailor ESG practices to the unique circumstances, industry, and organisational context within Malaysia. This ensures that sustainability initiatives are relevant, effective, and culturally appropriate, resulting in a more genuine and sustainable impact.

Embrace Incremental Innovations: For Small and Medium-sized Enterprises (SMEs), ESG adoption can be achieved through incremental innovations that do not necessarily require significant capital expenditures. This approach makes sustainability accessible to businesses of all sizes, allowing them to integrate practices and build capabilities over time.

The confluence of these best practices emphasises that effective ESG integration in Malaysia is a holistic endeavour encompassing internal strategic embedding, robust data management, and sophisticated external communication. The intense focus on transparency, measurable outcomes, and consistent storytelling indicates that simply “doing good” is insufficient; companies must also “tell their story well” with credible, contextualised data to maximise impact, build stakeholder trust, and attract responsible investment. The crucial advice against “blind adoption” further highlights the need for localised and tailored strategies for genuine and sustainable impact within the Malaysian context.

Conclusion: Charting a Sustainable Future for Malaysia

The journey towards a sustainable future is a complex yet imperative undertaking for businesses worldwide. In Malaysia, the concepts of Corporate Social Responsibility (CSR), Sustainable Development Goals (SDGs), and Environmental, Social, and Governance (ESG) are not abstract ideals, but vital, interconnected frameworks that drive this national imperative. CSR, rooted in a company’s ethical commitments, lays the foundation for responsible conduct. The SDGs provide a universal blueprint, offering a global language and common targets for businesses to align their efforts towards a better world. ESG, with its focus on measurable criteria and financial materiality, serves as the critical bridge, translating ethical intentions and global ambitions into quantifiable, accountable, and investable business practices.

Malaysia has demonstrated a robust and forward-thinking commitment to integrating these frameworks into its economic fabric. Through comprehensive policy landscapes, proactive regulatory initiatives by bodies such as MITI, BNM, SC, and Bursa Malaysia, and a strategic emphasis on capacity building and phased adoption, the nation is actively fostering a “sustainability mindset” across its industries. The rapid surge in ESG awareness and adoption among Malaysian SMEs, coupled with the tangible financial benefits reported, signals a market-driven tipping point where sustainability is increasingly recognised as a pathway to competitive advantage, increased revenue, and long-term resilience.

For Malaysian businesses, embracing these frameworks is no longer an option but a strategic necessity. By embedding ESG considerations into their core strategies, setting ambitious goals aligned with SDGs, leveraging technology for transparency, and engaging authentically with stakeholders, companies can not only meet evolving regulatory demands but also unlock new opportunities for innovation and growth. The emphasis on transparent reporting, measurable outcomes, and compelling storytelling ensures that efforts are credible and impactful, attracting responsible investment and building enduring trust.

Malaysia’s integrated and proactive approach to CSR, SDGs, and ESG is not merely about achieving compliance; it is about building long-term national resilience, enhancing economic competitiveness, and ensuring societal well-being. This positions Malaysia as a leading example in sustainable development within the region, offering significant opportunities for businesses that strategically align with this national vision. The future of business in Malaysia is undeniably sustainable, and those who proactively integrate these principles will be best positioned to thrive in this evolving landscape.

Works cited

- ESG In Malaysia | ESG Sustainability – ESG Impact, accessed July 24, 2025, https://www.esgimpact.com.au/esg-in-malaysia

- Case Studies | National Small Business Environmental Program, accessed July 24, 2025, https://nationalsbeap.org/small-businesses/sustainability/case-studies

- Corporate Social Responsibility – Definition and History, accessed July 24, 2025, https://www.financialeducatorscouncil.org/corporate-social-responsibility-definition-and-history/

- How CSR, SDGs And ESG Are Building A Sustainable Malaysia, accessed July 24, 2025, https://www.businesstoday.com.my/2025/07/13/how-csr-sdgs-and-esg-are-building-a-sustainable-malaysia/

- Corporate Social Responsibility – Part 1: Definition, History, Pyramid, and Models of CSR, accessed July 24, 2025, https://www.esgvoices.com/post/corporate-social-responsibility-part-1-definition-history-pyramid-and-models-of-csr

- How to Use Storytelling to Bring Your ESG Strategy to Life – Prophet, accessed July 24, 2025, https://prophet.com/2022/10/how-to-use-storytelling-to-bring-your-esg-strategy-to-life/

- What are SDGs, CSR, ESG?, accessed July 24, 2025, https://csradvise.com/what-are-sdgs-csr-esg/

- Lighting the Path to Sustainable Impact: ESG 2.0 Report – Malaysia – School of Business, accessed July 24, 2025, https://www.monash.edu.my/business/News-and-Events/articles/2025/lighting-the-path-to-sustainable-impact-esg-2.0-report

- Sustainable Development Goals – Wikipedia, accessed July 24, 2025, https://en.wikipedia.org/wiki/Sustainable_Development_Goals

- Sustainable Development Goals: 17 Goals to Transform our World | United Nations, accessed July 24, 2025, https://www.un.org/en/exhibits/page/sdgs-17-goals-transform-world

- SUSTAINABILITY REPORTING GUIDE – Bursa Malaysia, accessed July 24, 2025,https://www.bursamalaysia.com/sites/5bb54be15f36ca0af339077a/assets/5cc04d415b711a730ef06262/Bursa_Malaysia_Sustainability_Reporting_Guide-2ndEdition.pdf

- What are SDGs, CSR, ESG? Do You Know the Differences? – Market Prospects, accessed July 24, 2025, https://www.market-prospects.com/articles/what-are-sdgs-csr-esg

- ESG’s gradual integration into Malaysia’s financial sector – Law.asia, accessed July 24, 2025, https://law.asia/esg-integration-malaysian-financial-sector/

- ESG: Definition, 3 pillars and measurement methods – Greenscope, accessed July 24, 2025, https://www.greenscope.io/en/esg

- www.esgbc.ca, accessed July 24, 2025, https://www.esgbc.ca/what-is-esg/#:~:text=Environmental%2C%20Social%20and%20Governance%20(ESG)%20is%20a%20comprehensive%20framework,the%20quality%20of%20governance%20structures.

- Top 5 ESG Report Examples from Leading Organizations – Lythouse, accessed July 24, 2025, https://www.lythouse.com/blog/esg-report-examples-from-leading-organizations-in-multiple-industries

- IMPACT STORY – UN Global Compact, accessed July 24, 2025, https://unglobalcompact.org/take-action/impact/france

- ESG Malaysia: The Regulatory Framework, accessed July 24, 2025, https://www.ajinomoto.com.my/asv/commitment-to-global-sustainable-development/esg

- The ABCs of ESG reporting: What are ESG and sustainability reports, why are they important, and what do CFOs need to know – Wolters Kluwer, accessed July 24, 2025, https://www.wolterskluwer.com/en/expert-insights/the-abcs-of-esg-reporting

- Malaysia National Industry Environmental, Social and Governance framework | ESG Innovation for Sustainable Manufacturing Technology – IET Digital Library, accessed July 24, 2025, https://digital-library.theiet.org/doi/10.1049/PBME027E_ch4

- Bursa Malaysia Updates ESG Reporting Requirements for Listed Companies – Elite Asia, accessed July 24, 2025, https://www.eliteasia.co/bursa-malaysias-updates-on-sustainability-reporting-framework-

- for-listed-companies/

- Sustainable and Responsible Investment Roadmap for the Malaysian Capital Market – Publications and Research | Securities Commission Malaysia, accessed July 24, 2025, https://www.sc.com.my/resources/publications-and-research/sri-roadmap

- iESG – Ministry of Investment, Trade and Industry, accessed July 24, 2025, https://www.miti.gov.my/index.php/pages/view/9849

- ESG awareness among SMEs surges – The Malaysian Reserve, accessed July 24, 2025, https://themalaysianreserve.com/2025/02/05/esg-awareness-among-smes-surges/

- Malaysia’s Leading Sustainability & CSR Companies – The Top 10, accessed July 24, 2025, https://www.top10asia.org/rankings/malaysias-leading-sustainability-csr-companies-the-top-10/

- Best Practices for Communicating Your ESG Story: Top 4 Key Lessons – Lythouse, accessed July 24, 2025, https://www.lythouse.com/blog/communicating-your-esg-story

- Top 12+ Successful Sustainability Case Studies in 2025 – Research AIMultiple, accessed July 24, 2025, https://research.aimultiple.com/sustainability-case-studies/

- 11 Sustainability Report Examples by Industry Giants – Storydoc, accessed July 24, 2025, https://www.storydoc.com/blog/sustainability-report-examples

- IMPACT STORY: Beijing | UN Global Compact, accessed July 24, 2025, https://unglobalcompact.org/take-action/impact/beijing-company-looks-to-global-compact-in-its-gender-equality-efforts

Written by:

Jodie Tan | Sustainpreneur