WHY IS ESG IMPORTANT?

Malaysia’s ESG Journey: Bursa Malaysia’s Role and Corporate Sustainability Leadership

The global business landscape has increasingly prioritised Environmental, Social, and Governance (ESG) considerations, moving them from peripheral concerns to core strategic imperatives. In Malaysia, Bursa Malaysia has emerged as a central force, actively shaping the nation’s corporate sector towards greater sustainability and responsible practices. This report details Malaysia’s evolving ESG journey, highlighting Bursa Malaysia’s pivotal role in driving this transformation and showcasing leading Public Listed Companies (PLCs) that exemplify robust sustainability reporting and compliance.

ESG

Bursa Malaysia’s Leadership in Advancing Malaysia’s ESG Landscape

Bursa Malaysia has been at the forefront of integrating ESG principles into the Malaysian corporate framework, fostering a competitive and responsible business environment. Its efforts span regulatory mandates, market-based incentives, and extensive capacity-building initiatives.

Historical Context and Regulatory Evolution

Malaysia’s formal commitment to corporate sustainability, driven by Bursa Malaysia, began to solidify in recent years. A significant milestone occurred in 2015 when Bursa Malaysia mandated that all publicly listed companies include sustainability disclosures in their annual reports. This requirement marked a crucial step towards embedding sustainability into mainstream business strategies, moving beyond a voluntary Corporate Social Responsibility (CSR) framework to a more structured and transparent reporting regime.

The regulatory framework was further strengthened with the 2021 revision of the Malaysian Code on Corporate Governance (MCCG), which explicitly assigns responsibility to boards and senior management for managing ESG risks and opportunities. These early and progressive regulatory actions positioned Malaysia as a proactive leader in formalising sustainability expectations for its listed entities, setting a precedent that many regional counterparts would later follow. This forward-looking approach has been instrumental in cultivating a corporate culture that recognises sustainability as a fundamental aspect of long-term value creation.

ESG Storyteller

Bringing Your ESG JOURNEY to Life

The Regulatory Backbone

Bursa Malaysia has systematically built a robust ESG framework through a series of strategic mandates and initiatives, transforming the corporate landscape.

• Comprehensive Guidance and Tools

Bursa Malaysia publishes the Sustainability Reporting Guide to assist listed companies in complying with their reporting obligations, covering areas such as sustainability governance structure, materiality assessment, management methodologies, performance targets, and data tables.

The guide also encourages disclosures aligned with the Task Force on Climate-Related Financial Disclosures (TCFD) Recommendations, for which Bursa Malaysia is an official supporter. This enables companies to recognise and anticipate climate change-related risks and opportunities.

It provides Sustainability Toolkits and BURSASUSTAIN, an online knowledge portal, to support the development of corporate governance and sustainability practices among listed companies, investors, and other stakeholders.

• Centralised Data Platform

Bursa Malaysia, in collaboration with the London Stock Exchange Group, developed the Centralised Sustainability Intelligence (CSI) Platform. This platform is designed to be the national infrastructure for companies’ sustainability-related disclosures, allowing PLCs and Micro, Small, and Medium Enterprises (MSMEs) to consolidate and disclose ESG data in a standardised manner, thereby streamlining reporting and enhancing data credibility.

The CSI Platform aims to facilitate effective supply chain management and unlock sustainable project/supply chain financing opportunities. An Early Adopter Programme (EAP) is already underway with leading corporates and financial institutions.

• Incentivising ESG Integration

The FTSE4Good Bursa Malaysia Index, introduced in partnership with FTSE Russell, serves as an ESG index that highlights companies with leading ESG practices, supports investors in making ESG investments, encourages best practice disclosures, and aims to attract capital focusing on ESG risks.

These initiatives aim to improve the quality of sustainability-related practices and reporting, help listed issuers meet stakeholder expectations, and attract funds with a sustainability focus to the Malaysian capital market.

• Impact on the Corporate Landscape

Companies listed in the FTSE4Good Bursa Malaysia (F4GBM) Index that have demonstrated strong ESG business practices have been able to deliver higher valuation multiples and investment returns.

As of 2020, 73 companies listed on Bursa Malaysia had successfully met globally benchmarked ESG criteria, and by 2021, 934 listed companies published sustainability reports.

This systematic approach contributes to building stronger, more adaptive businesses and communities, aligning with global demands for sustainable products and transparency, and potentially providing easier access to international markets.

As of 2021, 934 companies listed under Bursa Malaysia published sustainability reports

ESG Storyteller

Shaping Sustainable Malaysian Landscapes

ESG in Action: Building Resilient Landscapes

Key Frameworks and Initiatives

Bursa Malaysia employs a multi-faceted approach to promote good ESG practices, encompassing mandatory reporting, market indices, and educational programs.

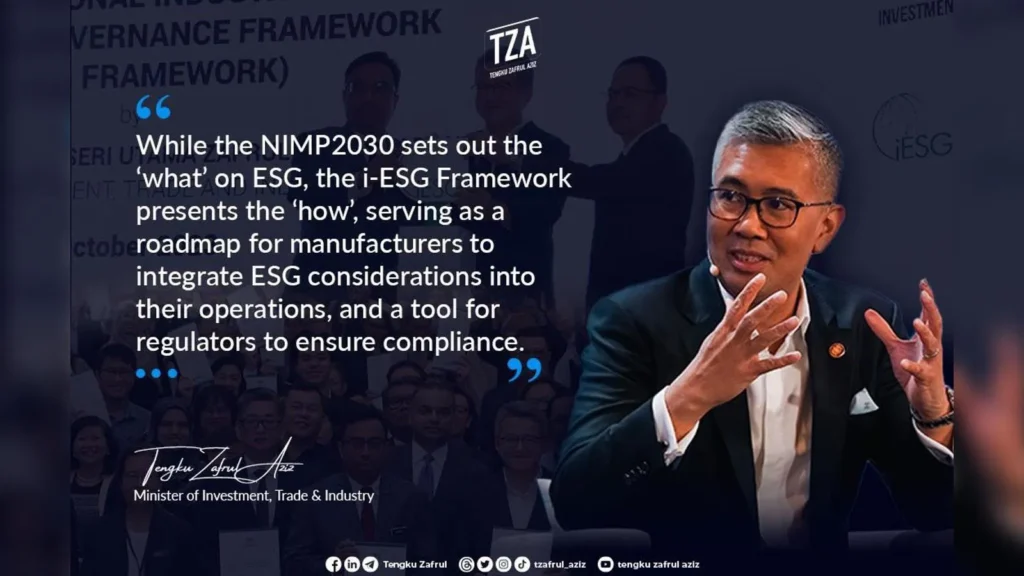

According to Minister of Investment, Trade & Industry, Tengku Datuk Seri Utama Zafrul Aziz, while the NIMP 2030 “sets out the ‘what’ on ESG, this i-ESG Framework presents the ‘how’, serving as a roadmap for businesses to integrate ESG considerations into their operations, and a tool for regulators to ensure compliance and accountability.”

Enhanced Sustainability Reporting Requirements

Since 26 September 2022, Bursa Malaysia has required all Main and ACE Market issuers to disclose comprehensive ESG information in their annual Sustainability Statements under enhanced Listing Requirements. These requirements are designed to align Malaysian companies with global reporting expectations, notably incorporating recommendations from the Task Force on Climate-related Financial Disclosures (TCFD) and moving towards International Financial Reporting Standards (IFRS) International Standards.

The enhanced framework mandates four key disclosures:

- Common Sustainability Matters: A prescribed set of sustainability issues and indicators deemed material for all listed issuers.

- TCFD-aligned Disclosures: Detailed reporting on climate change-related risks and opportunities.

- Enhanced Quantitative Information: Companies must provide at least three financial years’ worth of data for each reported indicator, along with corresponding targets and a summary in a prescribed format.

- Statement of Assurance: A declaration indicating whether the Sustainability Statement has undergone internal review by auditors or independent assurance.

The implementation of these new requirements is phased to allow companies adequate time for adaptation. Main Market-listed issuers began disclosing common sustainability matters for financial years ending (FYE) on or after 31 December 2023, with TCFD-aligned disclosures culminating for FYE on or after 31 December 2025. Similarly, ACE Market-listed corporations will adopt enhanced sustainability disclosures on a staggered basis, with prescribed information taking effect for FYE on or after 31 December 2024, and concluding with basic transition plan disclosures for FYE on or after 31 December 2026. This carefully calibrated approach, balancing regulatory stringency with practical implementation timelines, is essential for ensuring a smooth transition and fostering higher quality disclosures across the market.

National Sustainability Reporting Framework (NSRF)

In May 2023, Malaysia introduced the National Sustainability Reporting Framework (NSRF) through the establishment of the Advisory Committee on Sustainability Reporting (ACSR). The primary objective of the NSRF is to elevate ESG reporting standards across all sectors by gradually adopting the International Sustainability Standards Board (ISSB) standards. The phased adoption begins with large listed issuers in 2025, providing smaller companies with additional time to adjust. This strategic alignment with global benchmarks, particularly the ISSB standards, is expected to significantly enhance the comparability and credibility of Malaysian companies’ sustainability disclosures on the international stage, which is vital for attracting global sustainable investment.

Bursa Malaysia ESG Reporting Platform

To facilitate compliance, Bursa Malaysia launched its ESG Reporting Platform on 4 December 2023, accessible through the Bursa LINK system. This platform provides a structured environment for submitting mandatory sustainability disclosures, ensuring strict data integrity and standardised reporting. It requires listed issuers to generate a concise Performance Data Table, which must be incorporated into the company’s Sustainability Statement. This technological enablement streamlines the reporting process and improves data quality, directly addressing the increasing demand for transparency from investors and regulators.

FTSE4Good Bursa Malaysia Index

Bursa Malaysia’s commitment to ESG is also reflected in its FTSE4Good Bursa Malaysia Index. This index is specifically designed to measure the performance of companies demonstrating strong ESG practices, thereby promoting awareness and providing investors with a tool to assess companies based on their ESG initiatives. Companies listed on this index gain enhanced credibility, leading to increased investor interest in businesses that align with ESG principles. The index serves as a powerful market signal, incentivising companies to continuously improve their ESG performance by offering greater visibility and attracting responsible capital.

Advocacy Programs and Resources

Beyond regulatory mandates, Bursa Malaysia actively conducts workshops, seminars, and educational programs to promote the importance of ESG practices. These programs, along with various guidebooks and video resources, assist PLCs in developing robust approaches to ESG reporting and integrating sustainability into their operations effectively. These capacity-building initiatives are crucial, as they recognise that successful ESG integration requires not just mandates but also comprehensive support and education for the corporate sector.

Key Elements of ESG Reporting for PLCs

To effectively comply with Bursa Malaysia’s enhanced ESG reporting requirements, companies must follow a structured approach that emphasises data integrity, stakeholder engagement, and continuous improvement.

Materiality Assessment

A cornerstone of effective ESG reporting is the materiality assessment. This process requires Malaysian PLCs to engage both internal and external stakeholders to identify the most relevant ESG issues impacting their business. A sustainability matter is considered material if it reflects the company’s significant economic, environmental, and social impacts or influences the assessments and decisions of its stakeholders. Companies are encouraged to present this in a Materiality Matrix, visualising the importance and impact of these factors. This ensures that reporting efforts are focused on issues that are genuinely significant to the company’s operations and its broader stakeholder ecosystem.

Disclosure Requirements

The enhanced sustainability reporting framework specifies detailed disclosures that PLCs must include in their Sustainability Statements:

- Governance Structure: Reporting on who is responsible for overseeing and managing the company’s sustainability matters, including strategic management and scope.

- Scope and Basis: Clearly defining the boundaries and methodology of the Sustainability Statement.

- Material Sustainability Matters: Explaining how these matters were identified, their importance, and how they are managed through policies, actions, and performance indicators.

- Methodologies for Indicators: Detailing the approaches used to measure performance.

- Performance Targets: Disclosing specific targets set for each indicator.

- Statement of Assurance: A statement on whether the report has been internally reviewed or independently assured.

- TCFD-aligned Disclosures: Including climate-related risks and opportunities in a dedicated section.

Furthermore, companies are required to provide quantitative data for the last three financial years for each reported indicator, along with corresponding targets and a summary in a prescribed format. This shift towards detailed, historical quantitative data enhances the comparability and reliability of disclosures, enabling investors and regulators to track progress over time.

Assurance and Credibility

To strengthen the credibility and reliability of Sustainability Statements, Bursa Malaysia requires that these reports undergo either an internal review by the company’s internal auditor or an independent assurance performed under recognised assurance standards. If independent assurance is obtained, the subject matter, scope covered, and conclusions must be disclosed. This emphasis on third-party verification is crucial for building trust in the reported ESG data, a critical factor for investor confidence and market integrity.

Continuous Improvement and Monitoring

The ESG landscape is dynamic, with evolving policies, regulations, and best practices. Bursa Malaysia encourages companies to continually update their strategies and reporting processes in response to new guidelines and performance feedback. This iterative approach, which includes soliciting input from stakeholders and incorporating lessons learned, is vital for driving long-term positive impact and ensuring that companies remain abreast of the latest developments in sustainability reporting.

Leading Public Listed Companies (PLCs) in Malaysia’s ESG Journey

Several Malaysian PLCs have demonstrated exceptional commitment to ESG integration and robust sustainability reporting, setting benchmarks for the industry. Their comprehensive disclosures and proactive initiatives highlight the tangible progress being made in Malaysia’s corporate sector.

Several Malaysian PLCs have demonstrated exceptional commitment to ESG integration and robust sustainability reporting, setting benchmarks for the industry. Their comprehensive disclosures and proactive initiatives highlight the tangible progress being made in Malaysia’s corporate sector.

Maybank Berhad

Maybank Berhad consistently publishes comprehensive sustainability reports, including its 2024 Environmental Report and 2023 Sustainability Report, providing a holistic view of its sustainability integration. A significant aspect of Maybank’s commitment is its Net Zero carbon emissions target by 2050, aligned with the Paris Agreement’s 1.5°C goal. The bank has established clear 2030 decarbonization targets for high-emitting sectors within its portfolio, such as Oil & Gas, Steel, Aluminium, and Palm Oil, covering 60% of its total financed emissions. This proactive approach to leveraging its financial influence for systemic change demonstrates a commitment to driving broader market transformation, rather than merely focusing on internal operational efficiency.

Maybank has also exceeded its Green, Social, Sustainable Impact Products and Services (GSSIPS) target, mobilising RM117 billion in sustainable finance between 2021 and 2024. Its focus on climate risk oversight is evident through the introduction of a Climate Risk Dashboard and the development of new Risk Acceptance Criteria for high-risk industries like hotels and semiconductors. The bank’s commitment extends to biodiversity, with initiatives like embarking on an afforestation strategy.

On the social front, Maybank is deeply involved in financial literacy programs, affordable home loans, and community investments. Its governance practices are robust, with reports undergoing review by the EXCO Sustainability Committee and the Board Sustainability Committee, and external assurance by SIRIM QAS International Sdn Bhd. The comprehensive nature of Maybank’s disclosures, covering both environmental and social aspects with strong governance, underscores its role as a holistic ESG leader. This integrated approach not only builds stakeholder trust but also enhances its attractiveness to global investors seeking responsible investment opportunities.

Axiata Group Berhad

Axiata Group Berhad, a prominent telecommunications conglomerate, publishes annual Sustainability & National Contribution Reports (SNCRs), detailing its material sustainability performance across its extensive operations in ASEAN and South Asia. Axiata’s reporting adheres to a wide array of internationally recognised frameworks, including the Global Reporting Initiative (GRI) Universal Standards 2021, Task Force on Climate-related Financial Disclosures (TCFD) Recommendations, Greenhouse Gas (GHG) Protocol, UN Global Compact’s (UNGC) 10 Principles, and the Science Based Targets initiative (SBTi) Business Ambition for 1.5°C campaign. This broad adherence to global standards signifies a sophisticated understanding of various stakeholder needs and a commitment to international comparability, which is vital for a multinational group.

Axiata is committed to achieving net-zero by no later than 2050 and has made progress in reducing Scope 1 emissions, recording a 6.5% reduction in 2023 through initiatives like replacing generator sets with lithium batteries and increasing solar sites. The company’s focus on digital integrity, encompassing robust cybersecurity and data privacy strategies, is particularly relevant for a telecommunications provider, demonstrating a proactive approach to managing sector-specific ESG risks and building trust in the digital economy. Furthermore, Axiata emphasises business ethics through its Anti-Bribery and Anti-Corruption Plan, and promotes fair, diverse, and inclusive employment practices, with women’s representation in senior leadership reaching 27% in 2023. The credibility of its disclosures is reinforced by independent limited assurance provided by PricewaterhouseCoopers PLT.

CIMB Group Holdings Berhad

CIMB Group Holdings Berhad’s 2024 Sustainability Report showcases its deep commitment to integrating economic, environmental, and social considerations into all aspects of its business decisions, from financing and investments to procurement and human capital management. CIMB has established itself as a leader in sustainable finance, being the first Malaysian bank to set clear 2030 decarbonization targets for its Oil & Gas and Real Estate portfolios, covering 60% of its total financed emissions. This strategic move demonstrates a proactive approach to leveraging its financial influence for systemic change, addressing the indirect yet substantial environmental footprint of its lending activities.

The Group has also significantly exceeded its Green, Social, Sustainable Impact Products and Services (GSSIPS) target, mobilising RM117 billion in sustainable finance between 2021 and 2024. Its leadership extends to social responsibility, where it was ranked #2 globally in Inclusive Finance by the World Benchmarking Alliance 2025 Financial System Benchmark. Notably, CIMB became the first Malaysian bank to extend its human rights grievance mechanism beyond internal operations to include communities and employees within clients’ businesses or supplier networks. This pioneering initiative and high ranking in Inclusive Finance highlight a profound commitment to social responsibility that goes beyond basic compliance, positioning CIMB as a holistic ESG leader. In terms of governance, CIMB has achieved a balanced pay ratio (1.00:1.01 male to female) and increased women’s representation in leadership to 42%, with its Board comprising 64% independent directors and 36% female directors.

Genting Malaysia Berhad

Genting Malaysia Berhad demonstrates a long-standing commitment to sustainability, as evidenced by its extensive archive of Sustainability Reports, which have been available annually since 2008 through 2023. This longevity indicates an embedded culture of sustainability and proactive engagement that significantly predates many mandatory reporting requirements by Bursa Malaysia, which began in 2015. The consistent publication of these reports over more than a decade suggests a mature approach to corporate responsibility. It provides valuable longitudinal data for stakeholders to analyse the company’s ESG performance and evolution. This sustained commitment underscores a strategic embrace of sustainability that predates its emergence as a widespread regulatory or market expectation.

PETRONAS Gas Berhad (PGB)

PETRONAS Gas Berhad (PGB), a key player in the energy sector, publishes comprehensive Sustainability Reports, with its 2024 report providing an overview of efforts to align economic ambitions with industry-leading ESG practices. The company emphasises the integration of robust environmental, social, and governance practices into every aspect of its operations and strategy.

In 2024, PGB expanded its Greenhouse Gas (GHG) Emissions reporting to include Scope 3 emissions, specifically from Business Travel and Employee Commuting. The inclusion of Scope 3 GHG emissions is a key indicator of advanced climate reporting, as these indirect emissions often represent a substantial portion of a company’s total footprint and are more challenging to measure. This demonstrates a more profound commitment to understanding and managing its full climate impact. PGB’s reports are prepared in alignment with both national and international sustainability reporting standards, ensuring transparency and relevance for stakeholders. The Board of Directors acknowledges its responsibility for the accuracy and integrity of the report, and the 2023 report received independent assurance from SIRIM QAS International Sdn Bhd. This drive for robust and credible sustainability performance is crucial for managing transition risks and attracting responsible capital within a carbon-intensive sector.

Analysis of Common Themes, Reporting Standards, and Best Practices Observed

The examination of Bursa Malaysia’s directives and the practices of leading PLCs reveals a clear trajectory for Malaysia’s corporate sustainability landscape. Several consistent themes emerge across these exemplary companies. There is a strong emphasis on ambitious Net Zero commitments and proactive decarbonization strategies, often extending to financed emissions for financial institutions and Scope 3 emissions for energy companies. Significant mobilisation of sustainable finance is also a recurring highlight, demonstrating a commitment to channelling capital towards greener and more responsible activities. Furthermore, robust governance structures, including substantial board diversity and ethical conduct, are consistently prioritised, alongside a deep commitment to social aspects such as human rights, diversity, and community investment.

These companies consistently leverage internationally recognised reporting frameworks. The Global Reporting Initiative (GRI) Standards are widely adopted for comprehensive sustainability disclosures. At the same time, the Task Force on Climate-related Financial Disclosures (TCFD) recommendations are central to climate-related risk and opportunity reporting. Other standards, such as the Sustainability Accounting Standards Board (SASB) for industry-specific metrics, the UN Sustainable Development Goals (SDGs), and the UN Global Compact principles, are also frequently integrated. The phased adoption of ISSB standards represents a clear future direction, further harmonising Malaysian reporting with global best practices.

Key best practices observed across these leading PLCs include a strong emphasis on independent third-party assurance of sustainability reports, which significantly enhances the credibility and reliability of reported data. There is also a notable shift towards providing detailed quantitative performance indicators, often accompanied by historical data, that move beyond mere qualitative narratives. Rigorous materiality assessments are employed to identify and focus on sustainability matters most relevant to the business and its stakeholders. Crucially, these companies demonstrate a deep integration of ESG considerations directly into their core business models, financial decisions, and long-term strategic planning, rather than treating them as isolated initiatives. They also set clear, time-bound targets for ESG performance and regularly report progress against these metrics.

The convergence of these leading PLCs on common themes and their adherence to multiple international reporting standards signifies a maturing ESG ecosystem within Malaysia’s corporate sector. This collective adoption of high standards indicates that companies are not merely complying with regulations but are actively competing on their sustainability performance. This dynamic drives overall market improvement, facilitates easier comparison and analysis for investors, reduces information asymmetry, and positions Malaysian PLCs as credible and attractive investment opportunities in the global sustainable finance landscape.

Conclusion

Bursa Malaysia has played a pivotal role in guiding Malaysia’s corporate sector towards a more sustainable and responsible future. Through a combination of progressive regulatory mandates, such as the mandatory sustainability disclosures and the phased adoption of ISSB standards, and market-based incentives like the FTSE4Good Bursa Malaysia Index, the exchange has fostered an environment where ESG considerations are deeply embedded in corporate strategy. The introduction of the Bursa Malaysia ESG Reporting Platform further streamlines compliance and enhances data integrity, reinforcing the nation’s commitment to transparency.

The journey of leading Public Listed Companies such as Maybank, Axiata, CIMB, Genting Malaysia, and PETRONAS Gas Berhad exemplifies the tangible progress being made. These companies demonstrate a proactive embrace of comprehensive ESG reporting, often exceeding regulatory minimums by setting ambitious decarbonization targets, mobilising significant sustainable finance, expanding the scope of their environmental disclosures to include Scope 3 emissions, and prioritising social equity and robust governance. Their consistent adherence to international reporting standards and pursuit of independent assurance underscore a commitment to credibility and comparability, positioning them favourably in the global sustainable investment landscape.

Malaysia’s ESG journey, orchestrated by Bursa Malaysia, reflects a strategic evolution from basic compliance to a sophisticated, integrated approach to environmental, social, and governance (ESG) sustainability. This concerted effort by both regulators and corporations is not merely about meeting obligations but about creating long-term value, enhancing corporate resilience, and attracting responsible capital, ultimately contributing to a more sustainable and prosperous economy for the nation.

Blog

Insights and Updates

Stay informed with the latest news, stories, and insights on global issues and our ongoing efforts.